OUR BUSINESS:

Benefits of saving with NSSF

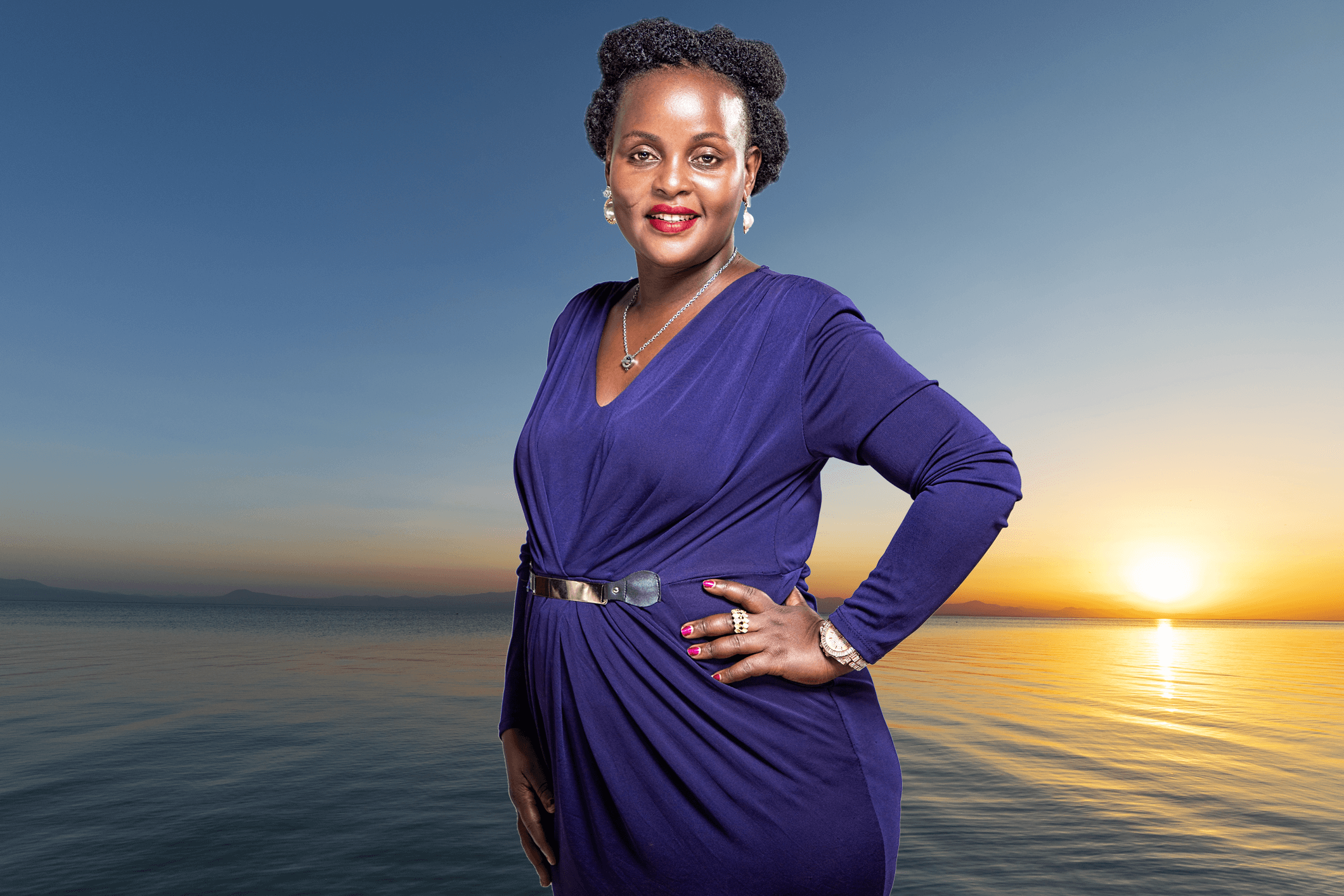

Meet Nakamya Annet:

A resilient entrepreneur, devoted wife, and mother of three, living in Seeta, Mukono District. Nakamya is the visionary behind Psalms One Enterprises Limited, a thriving business located on Nkrumah Road in Musana House, specialising in graphic design, printing corporate wear, and promotional items.

Her journey with NSSF began in 2005, and it has been a pillar of support throughout her career transition and health challenges.

1. When did you start your saving journey with NSSF?

I began my savings journey with NSSF in 2005 while working for various companies, with Graphics Systems (U) Limited being my first employer. In 2019, I decided to start my own business. I withdrew my savings in 2021 under the Invalidity Benefits Scheme. After starting my business in 2019, I decided to enrol in the NSSF Voluntary Programme and have been saving consistently since then.

2. When you commenced your savings journey with NSSF, how did you feel?

I had mixed feelings at the beginning since I did not have much knowledge about savings. But because it was mandatory, my employer continued to remit my savings until those savings saved my life in 2021 when I got Covid-19. It was the best thing that ever happened to me, and I had no doubt that the moment I started my own business, I would continue saving with NSSF.

Saving with NSSF transformed my life during a crisis. It provided a safety net when I needed it most, and allowed me to rebuild my business and secure my future. I encourage everyone to see saving as an essential emergency plan and a step toward a better tomorrow." – Nakamya Annet, Entrepreneur and NSSF Member.

3. How did you utilise your retirement benefits?

In 2021, I contracted Covid-19 and was admitted to the ICU for three weeks, relying on oxygen. Everything around me had crumbled. While in the hospital, I overheard my neighbour listening to the news on her phone, where I learned that NSSF was providing invalidity benefits to its members battling Covid.

Unable to access a computer or my phone, I asked my husband to apply and submit a request for my benefits. A doctor later came to validate some of the required information, and within three days, all my benefits were deposited into my account. These funds arrived incredibly quickly and proved invaluable. They enabled me to access the necessary medication, which was expensive at the time, and also helped me treat the post-Covid side effects, aiding in my recovery.

After I recovered, I used the remaining money to boost my business, which has since grown significantly. I am forever grateful for that support.

4. What message do you have for people struggling to save money or having challenges with managing their finances?

Initially, I believed that NSSF was only for those in formal employment, but you can contribute voluntarily even if you are self-employed.

Saving can be simplified by setting up a monthly standing order with your bank, which can be automatically remitted to your savings plan.

As you spend, make it a habit to set aside some money to secure your future and take care of your family.

Consider short-term investments that can be easily liquidated in case of emergencies, such as medical expenses or school fees.

It is important to manage your debts wisely. Only take on debt that you can comfortably repay with your available disposable income.

5. What message do you have for people planning to withdraw their retirement benefits?

If you are still able to work and earn, avoid withdrawing your NSSF savings prematurely. Your money is safe with NSSF. Consider enrolling in programmes like the voluntary savings plan, which allows you to continue saving even after the age of 55.

Before accessing your benefits, make sure you have a clear plan for how you will use them, particularly after retirement. Withdrawing your money in small amounts is less effective, as it may not be sufficient to invest in significant, rewarding projects. Instead, let your funds accumulate and earn interest, which you can access once you have a solid plan for how to use them.

The more you save, the greater your returns will be.

Avoid withdrawing your voluntary savings to pay off debts or cover school fees. Keep your retirement savings as a safety net for your family in case you are no longer able to work or provide for them. Ensure that your personal information in the NSSF system is up to date so that, in the event of an emergency, your survivors can easily access the benefits.

6. Having accessed your retirement benefits, what advice do you have for people saving or planning to start saving with NSSF?

With NSSF, your savings are secure and wisely invested to generate a good return in the form of interest. Take advantage of the upcoming voluntary products that align with your financial goals.

Think of saving as an essential emergency plan. These savings can be a lifeline in times of health issues or family challenges.

For business owners, NSSF offers certificates that are essential when applying for supplier bids, providing an additional benefit of being an NSSF member.

In conclusion, I encourage everyone with dreams of enjoying a secure retirement to register through the self-registration process on the NSSF website and start saving with NSSF for a better future.

A NEW DAY - CREATING SHARED VALUE FOR SUSTAINABLE GROWTH