OUR REPORT OVERVIEW:

Managing Director's Statement

The past year stood out as one of resilience, determination, and remarkable performance. Despite the intrusive months of rigorous public investigation inquiry, we emerged from a challenging year even stronger. Our strong governance prevailed and sustained us. Member trust in NSSF remained steadfast. Demonstrating our members' unwavering faith in us, contributions and enrolments increased. The Fund grew by almost UGX 4Tn, underscoring the strength of our strategy.

This resilience gives us the foundation to lay out our strategy for Vision 2035. We are thinking bigger and bolder not only to solve today's problems; but to invest in solutions for a better tomorrow, for our members and for Uganda.

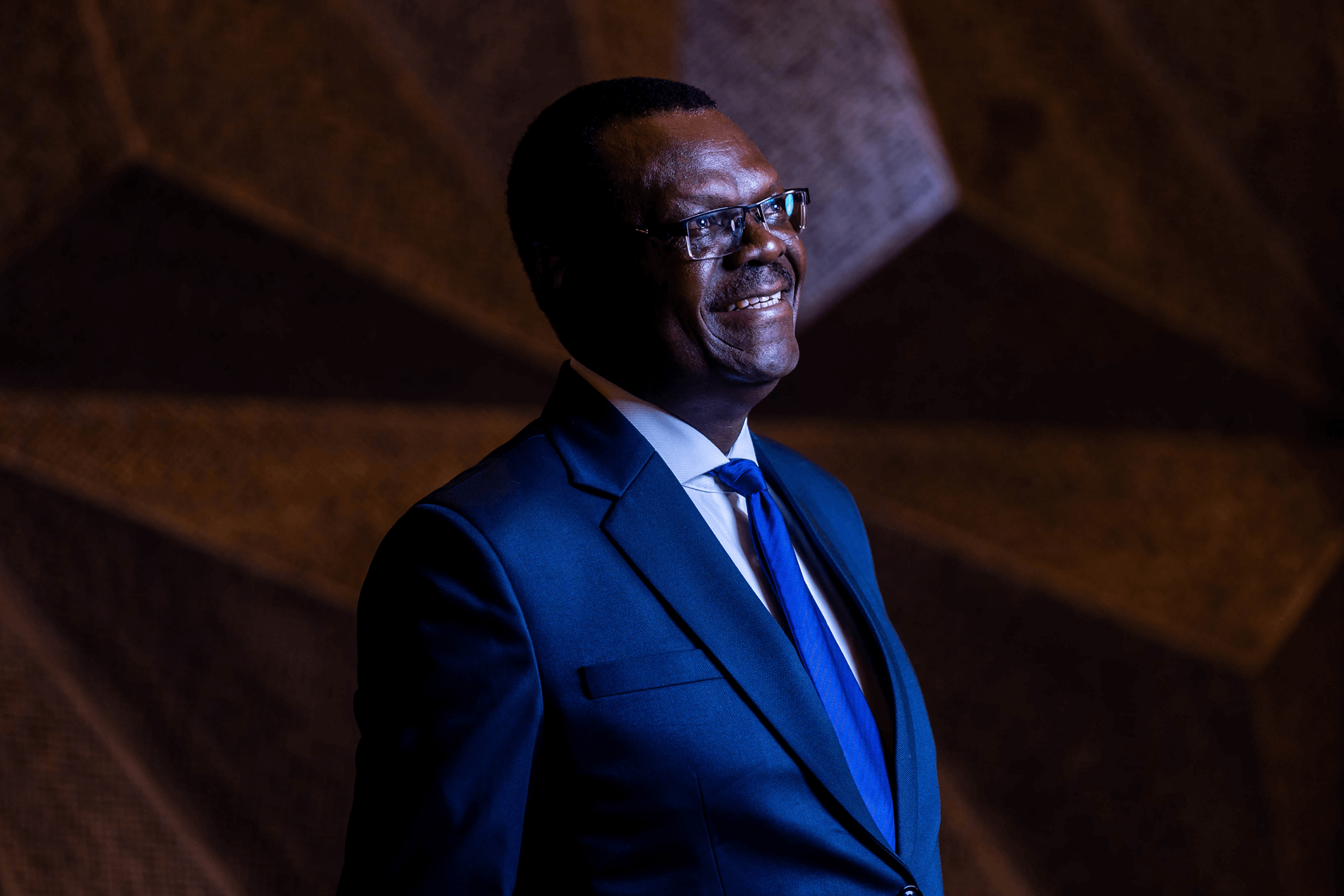

Patrick M Ayota Managing Director

Reflections on the past year

As we reflect on the past year, I am proud to share that the Fund has navigated through a period of both challenges and opportunities with resilience and strategic foresight.

Our commitment to innovation, excellence, and sustainability has been the cornerstone of our success, and I am pleased to report that we have achieved significant milestones in alignment with our long-term vision. The Fund has continued to earn the goodwill of our valued members and stakeholders.

Our reputation and strength remain steadfast, attracting top talent and positioning ourselves as a leading organisation within the region.

During FY2023/24, amidst the challenging environment, the Fund registered very good performance in the below key financial areas. This performance is a clear testament to the trust and confidence that our members continue to place in the Fund.

Fund's Assets grew by 19% from UGX 18.6Tn in the previous year to UGX 22.13Tn, exceeding our 2025 target of UGX 20Tn.

Total realised income grew by 15% from UGX 2.2Tn to UGX 2.5Tn, mainly driven by interest income.

Dividend income earned in the year grew by 21% from UGX 145Bn in the previous year to UGX 175Bn.

Contributions collected in the year grew by 13% from UGX 1.72Tn in the previous year to UGX 1.93Tn .

Vision 2035: Building a brighter future

Building upon our 2025 strategy, we have set ambitious targets for the next decade. Central to our strategy is an active role in the daily lives of young Ugandans, especially in the areas of agriculture and job creation. By promoting a culture of saving and enhancing the capacity to save, we aim to empower Ugandans to achieve greater financial security and prosperity. For 2035 we envision:

Coverage - 50%

As the Fund matures, more and more members will qualify to take their benefits, which will eventually exceed contributions. The Fund, therefore, must widen its coverage to attract new members. Currently, our coverage is at 11% of Uganda’s working population. We aim to expand this to 50%, reaching 15 million members. We aim to reach a significant portion of the eligible workforce, particularly within the informal sector.

Growth - UGX 50Tn

While our investment portfolio remains resilient, it faces global and local headwinds. We are focused on innovative growth strategies that align with national priorities in infrastructure development and industrialisation. We aim to grow the Fund to UGX 50Tn.

Satisfaction Rate - 95%

Our goal is to create value for all stakeholders—members, staff, government, and the public. We aim for an engagement and satisfaction rate of 95% as we roll out new initiatives including financial education, job creation programmes, and co-investments in priority economic sectors.

Strategic initiatives and technological advancements

As we enter a new decade, we must rethink and innovate our investment approaches to address long-term societal issues like unemployment. Our Hi-Innovator Programme has successfully created over 12,000 jobs and led to new contributions of UGX 530 million in savings. By supporting entrepreneurs and focusing on long-term investments, we not only help solve societal issues, but also stimulate economic growth, and environmental sustainability. Our specialised and female focussed entrepreneurial programs promote gender parity.

We are enhancing our in-house capabilities, nurturing talent, and driving technological innovation. Our internally developed Smart Life product is expanding our value proposition to meet short- to medium-term savings needs.

We have also established a dedicated department to explore partnerships, further supporting our Vision 2035 initiatives. By ensuring a smooth transition from Strategy 2025 to Vision 2035, we are committed to making lives better through meaningful and purposeful actions.

Sustainability and ESG commitments

We have seamlessly integrated ESG principles into our operations, solidifying our dedication to environmental, social, and governance responsibility.

We understand that sustainability is crucial for the long-term success of the Fund and our society.

Our initiatives align with SDG 8 (decent work and economic growth), SDG 1 (no poverty), SDG 5 (gender equality) and SDG 2 (zero hunger). We are actively involved in programmes that enhance financial literacy and create economic opportunities, particularly in agriculture.

Our emphasis is that sustainability is about building a strong organisation with longevity and prosperity while being a good corporate citizen. Our efforts are not just about ticking boxes; they are about genuinely making a difference for our planet, our place and our people.

Culture change at the Fund

In pursuit of our ambitious Vision 2035, we acknowledge the necessity of evolving our organisational culture. We are currently charting a roadmap to transition from our current state to our desired future. This initiative aims to enhance our agility, foster innovation, and ensure that every team member aligns with our vision and values.

Looking ahead: Transition to Vision 2035

As we pivot from Strategy 2025 to Vision 2035, our purpose remains clear: making savings a way of life and building a prosperous future for Uganda. We are mindful of our role in driving the country's development and growth agendas. By increasing domestic savings, we can significantly impact Uganda's economic stability. With Uganda’s long term domestic savings currently at 11% of GDP, we aspire to reach levels similar to those of Asian countries, which save at least 30% of GDP.

Exciting prospects include designing affordable housing using advanced technology. We aim to collaborate with other relevant partners to offer affordable healthcare insurance, ensuring access to basic healthcare for all. Additionally, we plan to work with key stakeholders to advocate for modifications to Uganda’s trust laws, which have been unchanged since 1949. We expect these efforts will lead to substantial advancements.

Appreciation

I extend my heartfelt gratitude to the Supervising Ministers, Chairman, members of the board of directors, and all stakeholders for their unwavering support. Special thanks to the Executive Team and NSSF employees for their hard work, dedication and commitment. Together, we are steadfast in our mission to make NSSF the Social Security Provider of Choice.

Patrick M Ayota, Managing Director

A NEW DAY - CREATING SHARED VALUE FOR SUSTAINABLE GROWTH