OUR GOVERNANCE:

DELEGATION TO BOARD COMMITTEES FOR EFFECTIVE OVERSIGHT

Committees of the Board

The Fund’s governance structure enables interaction between Management, members, and the Board.

The Board is supported by four standing Committees: Staff Administration and Corporate Affairs Committee, Finance Committee, Investments and Project Monitoring Committee and the Audit and Risk Committee.

Discussions are still ongoing regarding establishment of an independent Governance Committee to oversee succession planning of the Board and ESG issues.

Each of the standing Committees has formal and approved terms of reference stipulated in the Board Charter.

The Committees’ functions are for purposes of review, oversight, and monitoring. Their duties include investigating and analysing the relevant information and reporting back with recommendations to enable the Board to make appropriate decisions.

These Committees have delegated responsibility to assist in specific specialist matters on a collaborative basis and provide reports of their activities and recommendations to the Board on a quarterly basis or as often as is necessary.

The constitution, focus, activities, and outlook for each of the Board Committees are outlined below:

Audit and Risk Assurance Committee (ARC)

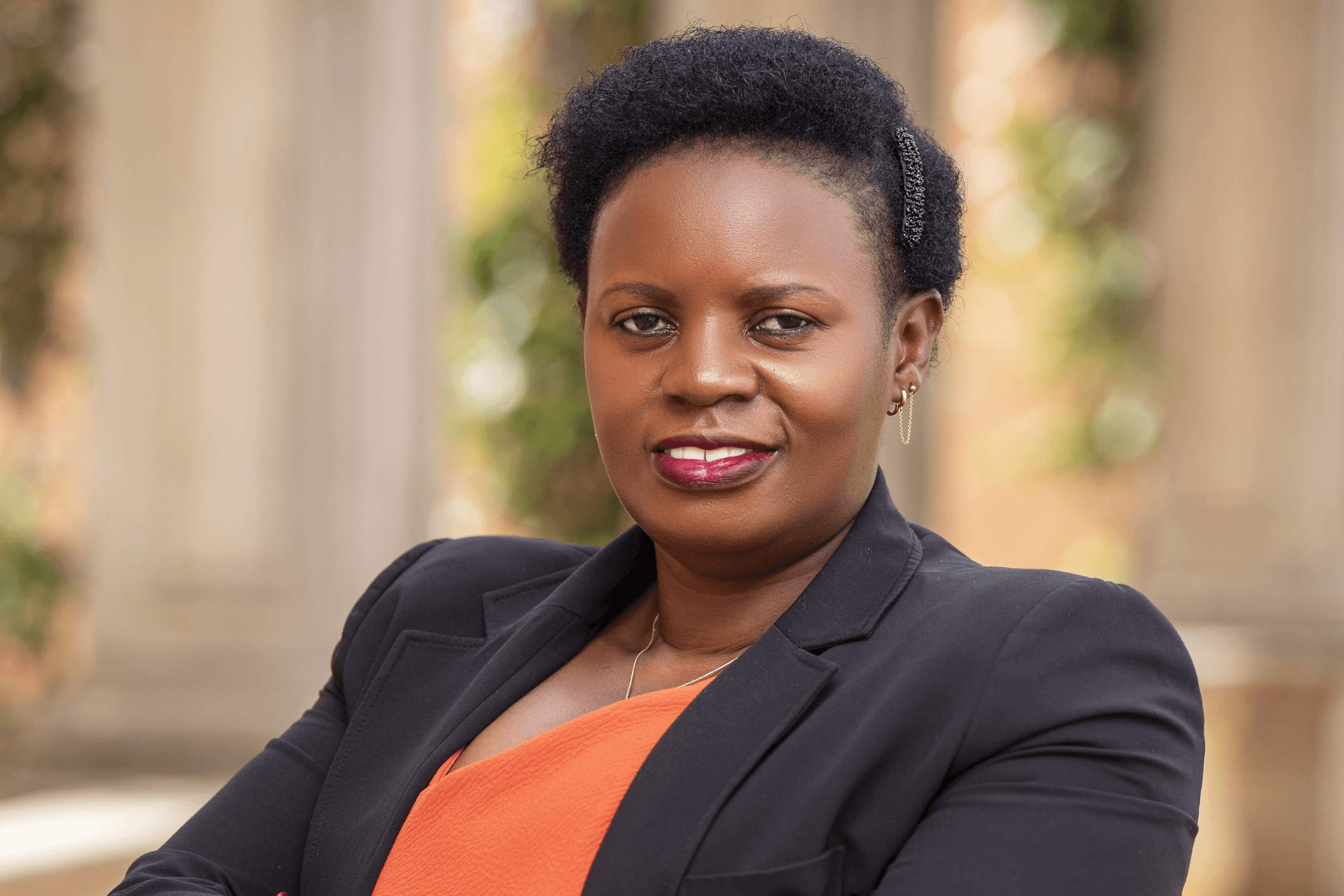

Chairperson

Members

(During the period 1 July 2023 to 30 June 2024)

Professional advisors

Committee purpose and how it contributes to value creation

The Committee is made up of only Non-Executive Directors and the MD only attends by invitation. The Head of Internal Audit reports directly into this committee which ensures independence of the Internal Audit function. The Corporation Secretary is the secretary of the Committee, the Head of Enterprise Risk Management and Head of Internal Audit may attend meetings upon request as ex-officio members.

The Committee helps the Board to effectively discharge its oversight responsibilities for financial reporting, risk management, internal controls, internal and external audit, regulatory compliance, and governance.

The ARC, on behalf of the Board, undertakes detailed monitoring of internal controls through the Internal Audit function. The Board has reviewed the system of internal control, including financial controls, for the year under review up to the date of approval of this Integrated Report.

Declaration

The Committee is satisfied that it has fulfilled its mandate as set out in the Committee’s terms of reference and work plan as required in the Board Charter during the period under review.

Key focus areas and value creating activities for the period under review

Key ARC Milestones in the FY 2023/2024:

ARC Committee’s key activities in FY2023/2024 included oversight, review, and consideration of:

Key engagements and considerations:

Future focus areas 2025

Key focus for the following year FY 2024/2025

Risks

The key risks in FY2023/24 include:

Capitals

King IV™

Stakeholders

A NEW DAY - CREATING SHARED VALUE FOR SUSTAINABLE GROWTH