OUR BUSINESS:

Financial and operational highlights

Financial highlights

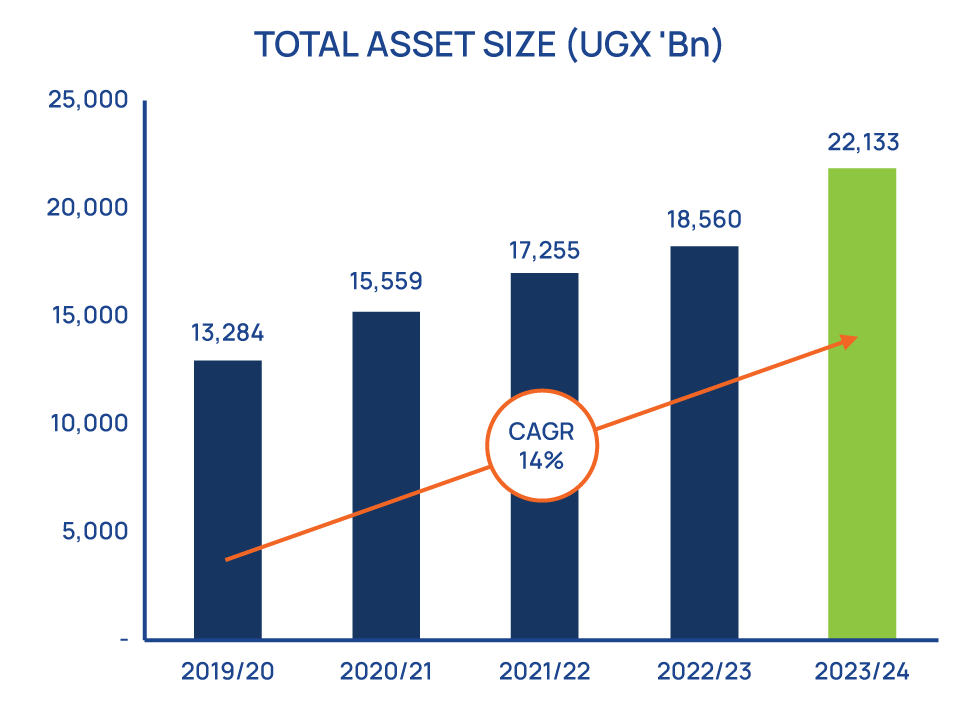

Asset Growth (UGX ’Bn)

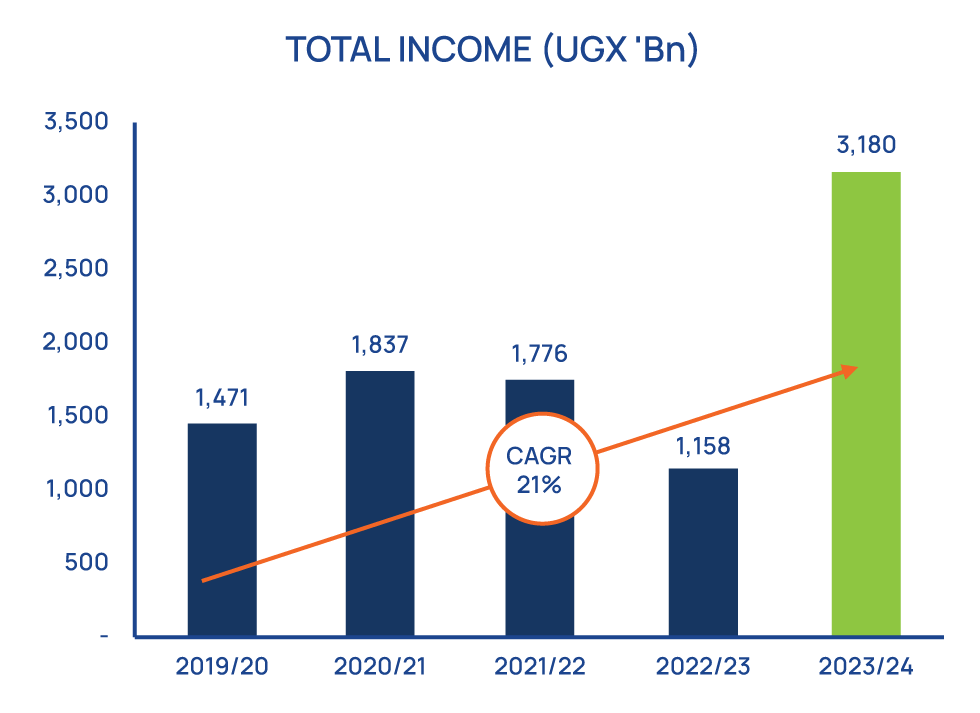

Total Income (UGX ’Bn)

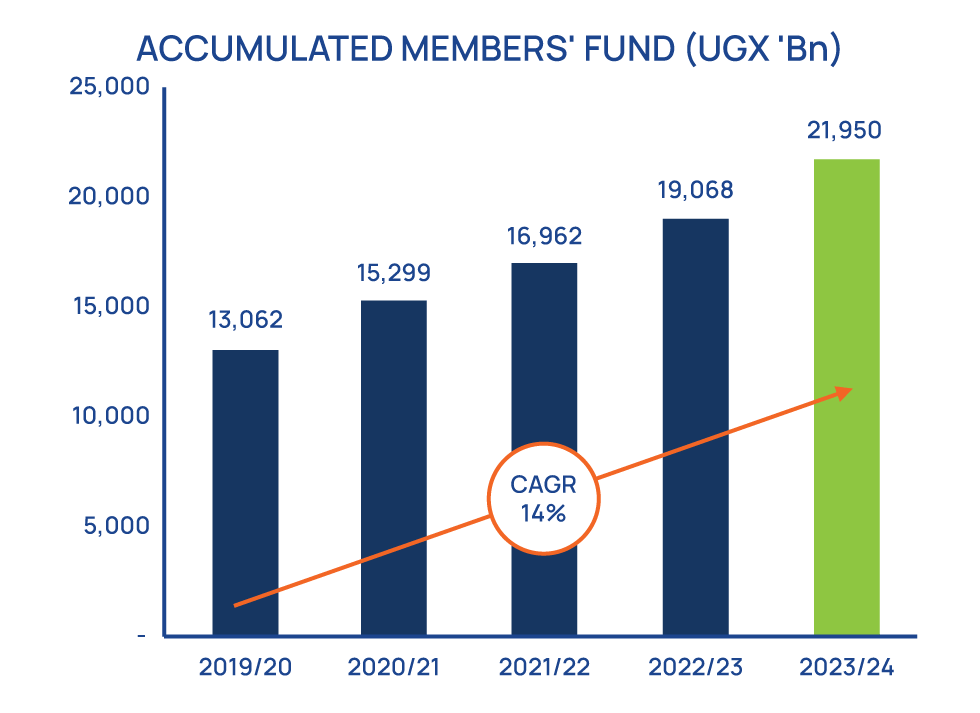

Accumulated Member Fund (UGX ’Bn)

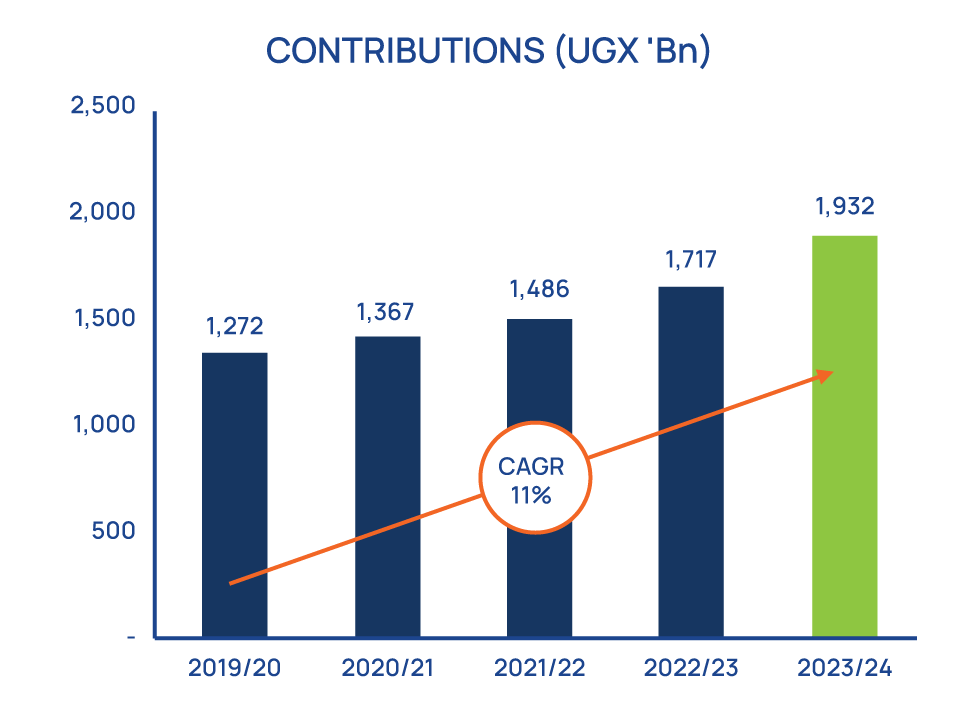

Growth in Contributions Collected (UGX ’Bn)

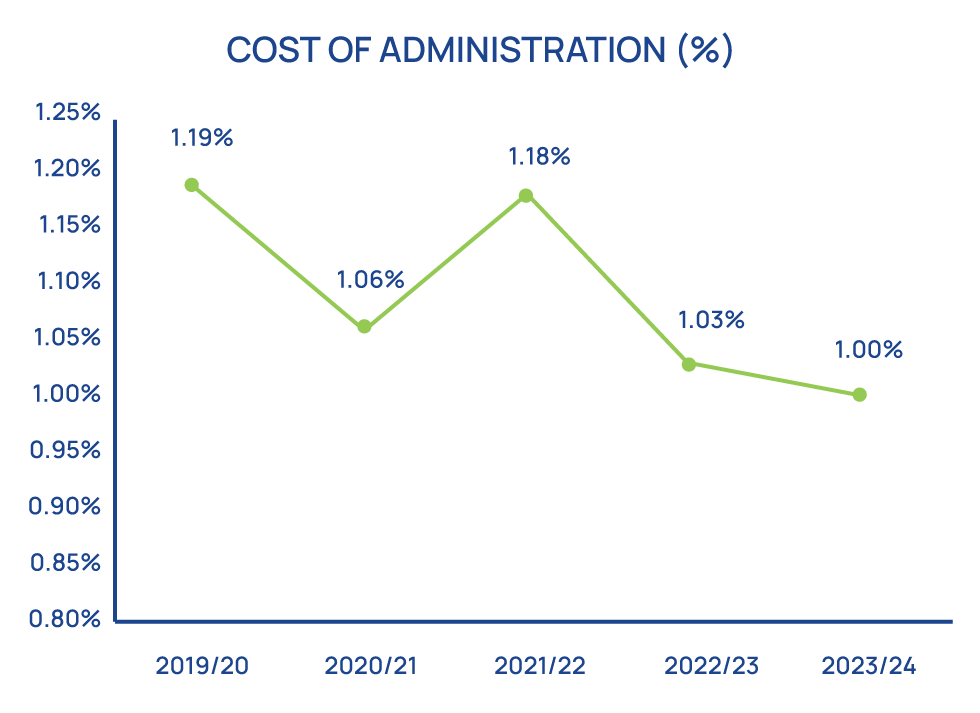

Cost of Administration (%)

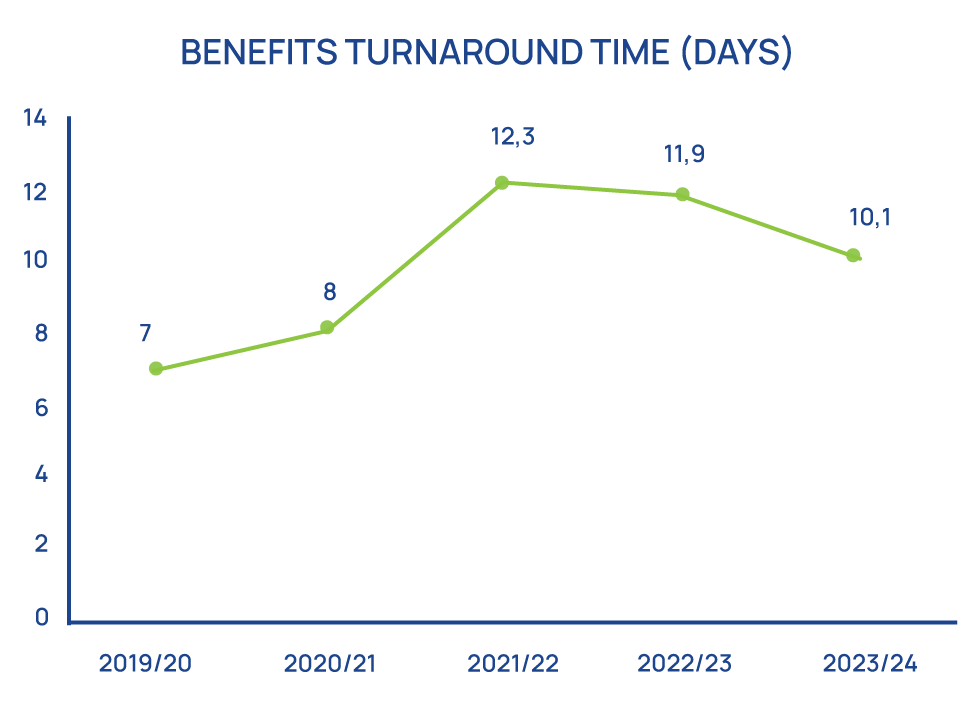

Benefits Turnaround Time (Days)

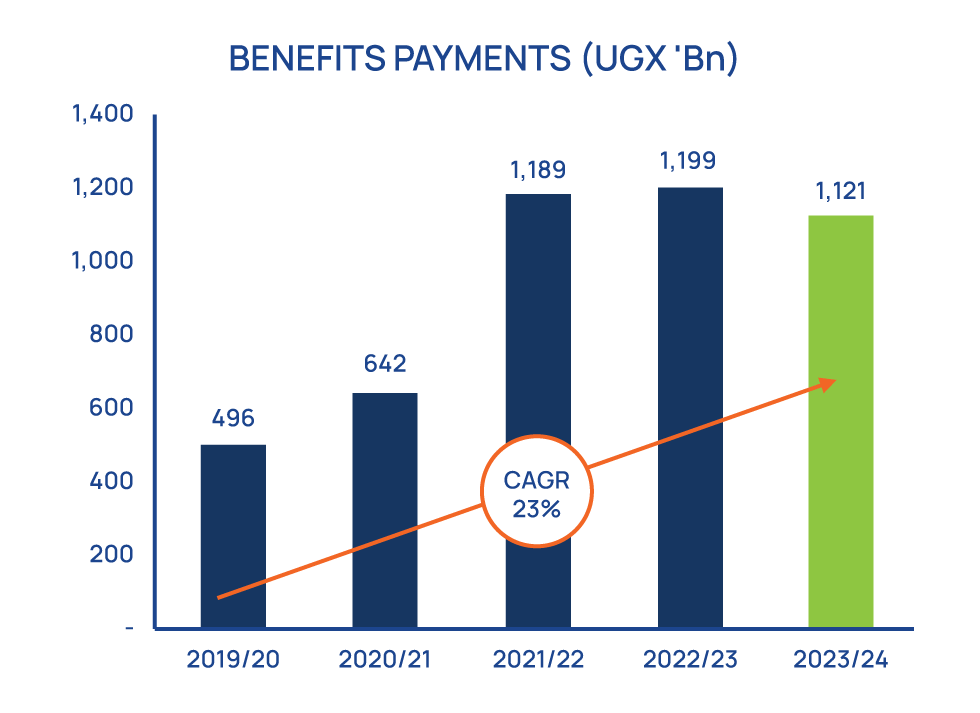

Benefits Paid (UGX ‘Bn)

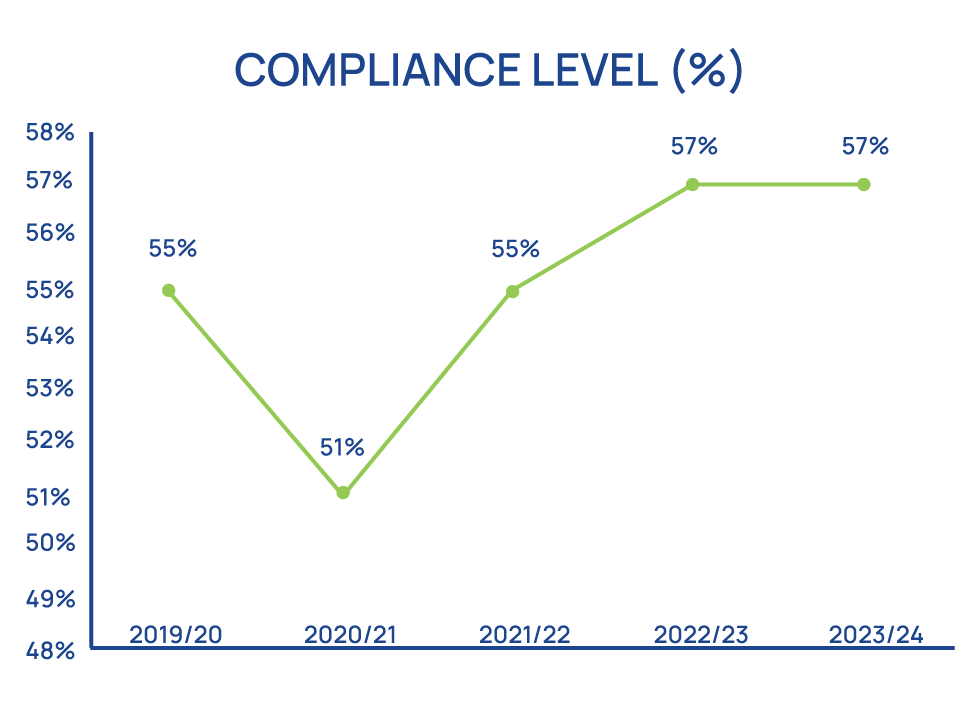

Compliance Level (%)

A NEW DAY - CREATING SHARED VALUE FOR SUSTAINABLE GROWTH