OUR STRATEGY:

Introduction to Strategy

Introduction

FY 2024/25 marks a pivotal year for the Fund. We will be concluding our 10-year strategic plan, endorsed by the Board in 2015, and embarking on a new transformative journey that will shape the business through 2035.

A strategic plan is not merely an expression of intent—it is a commitment that holds the Board and Management accountable, serving as a cornerstone of sound corporate governance.

Mr. Alex Rumanyika, Head of Strategy and Performance

As we reflect on our journey since 2015, it is important to revisit the core principles that guided our strategic vision:

Preserve the value of members’ savings

Simplify services through accessible and seamless channels

Empower members through innovative products

As we close this chapter and prepare for the future, we remain steadfast in our commitment to these foundational goals. Did we fulfil our intentions? Below is the scorecard.

Preserve Value

Sustain a return on member savings that is at least 2% above the 10-year moving average rate of inflation. The results validate the investment strategy of the Fund, which is designed to protect members savings against inflation-based erosion.

Members' savings are protected from inflation

Member interest on accumulated savings continues to consistently be above the 10-year average inflation rate.

The results validate the investment strategy of the Fund, which is designed to protect members savings against inflation-based erosion.

Simplify service through ubiquitous and seamless channels

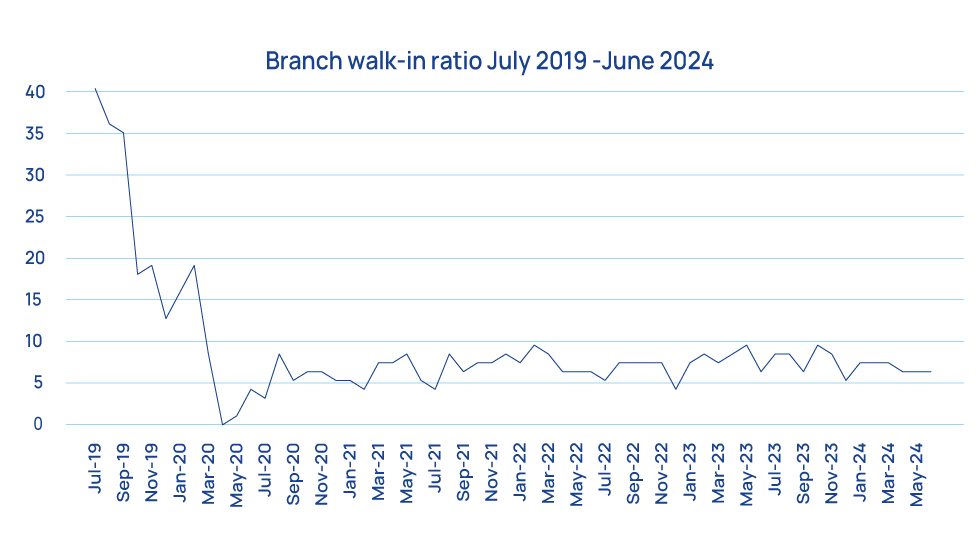

In 2015, over 70% of our members were served through a physical channel. Covid-19 changed the narrative. The pandemic presented a catalytic opportunity to transform our service offering to the point that digital is now the default service channel.

Members' access our service anywhere, any time

Today, 90% of our major services are conducted through digital channels, a significant achievement considering where we started in 2015. Back then, we processed 15,000 benefit claims. Fast forward to 2023, and the Fund has processed over 40,000 claims, disbursing UGX 1.1Tn—most of which was facilitated through our digital platforms.

Empower members through innovative products

The Fund's traditional mandate has been to offer a basic retirement package. However, in 2015, the Board challenged us to think beyond this. We committed to becoming a “relevant partner” in our members' journey to economic security. Our financial literacy programme is a key initiative in this mission, and we recognised that innovation is crucial in empowering our members.

To this end, we developed an innovation strategy focused on transforming members’ lifestyles through saving. By engaging with communities and co-creating value within these ecosystems, we have launched initiatives like Hi-Innovator, which supports start-ups and creates employment, expanding our membership base.

Additionally, we advocated for amending the NSSF Act to introduce new benefits addressing social security needs before retirement, leading to the creation of the Mid-term Access (MTA) benefit.

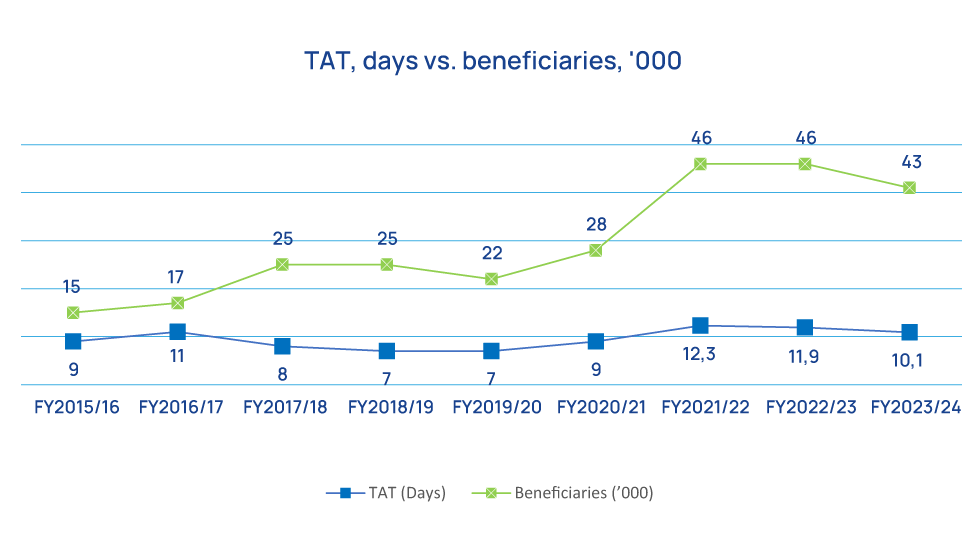

Benefits processing time (days) vs number of beneficiaries

The impact of MTA is clear; we nearly doubled the benefits paid in 2024 (43,000) compared to 28,000 in 2021. Initially introduced to help members cope with the adverse effects of the Covid-19 pandemic, MTA has become a mainstream benefit. However, members are now seeking more from the Fund, with affordable housing and medical insurance among their top demands.

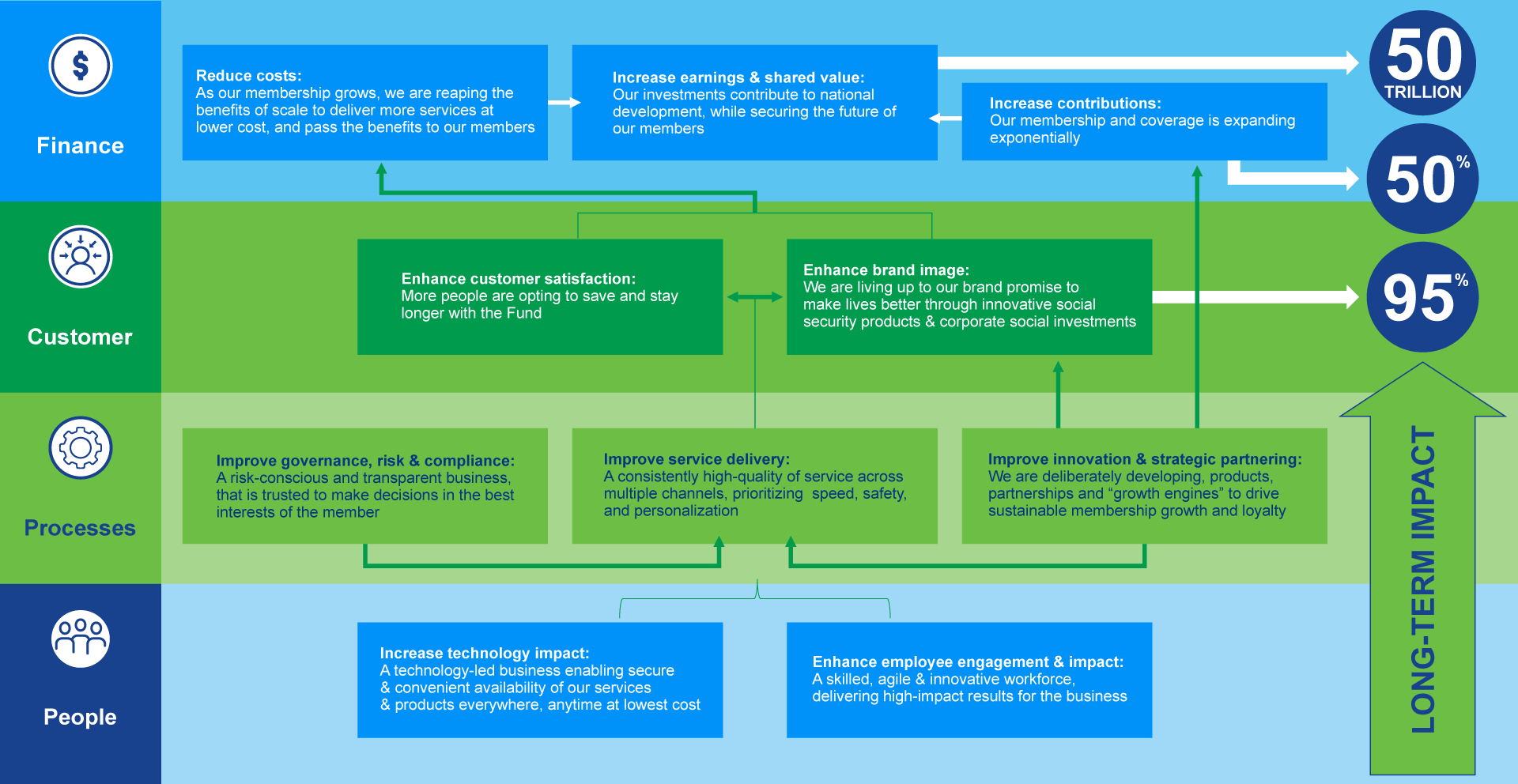

This aligns with the Managing Director’s Vision 2035 commitments. Our new strategic intent focuses on sustainability and shared value, positioning the Fund as a catalyst for Uganda's sustainable transformation. This vision is guided by three key metrics: 50%, 50 trillion, and 95%.

Strategic goal 1: 50%

Make saving a way of life to the extent that 50% of the labour force is consciously and actively saving for 50% long-term economic security

50% - Coverage of Social Security

Uganda's active labour force, currently at 17 million, is projected to reach 30 million by 2035. Yet, less than 10% of the workforce currently accesses our services. With 50% of the population under 18, fostering a culture of long-term saving is crucial to prevent widespread old-age poverty. Over the next 10 years, we aim to expand our membership from 2 million to 15 million, covering 50% of the workforce. Our strategy includes investing in strategic agricultural value chains to boost the earnings of 4 million farmers, who will then become active NSSF members.

Strategic goal 2: 50TR

Leverage the balance sheet to grow the alternative investment portfolio to sustain double-digit return on 50TR investment for the benefit of the member

UGX 50Tn – Assets under Management (AuM)

We recognise the need to diversify our investment portfolio, especially given our current exposure to government bonds and the evolving economic landscape. While prioritising safety and returns, the Fund will leverage its balance sheet over the next 10 years to attract private capital into strategic sectors of the economy.

The Government aims to grow GDP from USD 55 billion to USD 500 billion in this period, with a significant portion driven by infrastructure investment. However, relying solely on government borrowing (with a current debt-to-GDP ratio of 49%) is unsustainable. To achieve these goals, Uganda must adopt innovative financing models like Public-Private Partnerships (PPPs). NSSF will use its balance sheet and investment expertise to position Uganda as a prime destination for PPPs, ensuring sustainable double-digit returns for our members.

Strategic goal 3: 95%

Stakeholder satisfaction rate - premised on a robust environmental, social, and governance (ESG) framework 95% of change

95% – Stakeholder Satisfaction Rate

The Fund is a vital national institution, with a diverse range of stakeholders—starting with our people. Investing in their future is essential for our long-term sustainability. Our people strategy is built on key pillars: skills development, diversity, wellness, and fair pay. This foundation supports a customer-centric business, enabling us to develop products and services that resonate with our members and the public.

The success of the Fund is of public interest, especially in a country where 42% of the population lives in poverty. As a responsible institution, we are committed to closing the equity gap by creating jobs through responsible investing, entrepreneurship support, and financial literacy initiatives.

Our impact: Our theory of change

50,50 95 encapsulates our sustainability strategy and intent over the next 10 years. We are creating a Social Security Fund that works for every Ugandan. We call this shared value!

A NEW DAY - CREATING SHARED VALUE FOR SUSTAINABLE GROWTH