OUR SUSTAINABILITY:

Message from our Chairman

As we embrace 'A new day - creating shared value for sustainable growth', NSSF reaffirms its commitment to integrating ESG principles into our operations. A sustainable future forms the foundation of a flourishing economy, where the financial security of our members is intricately linked with environmental responsibility and social well-being. By championing this holistic approach, we empower Ugandans to drive sustainable economic development.

Dr. Peter Kimbowa, Chairman, Board of Directors

Securing financial futures and co-creating a sustainable ecosystem

This year's Sustainability Report marks a crucial point in NSSF's journey, where we are building a financially secure future for our members and actively co-creating a thriving social and environmental ecosystem.

I am delighted to share the Fund’s second Sustainability Report, highlighting our steadfast commitment to embedding sustainability into every facet of our operations.

Read our Sustainability Report here.

As we strive to make savings a universal practice and drive inclusive sustainable development, our journey over the past year has been marked by significant progress and strategic alignment. We significantly accelerated sustainability awareness at all levels in the organisation, including the Board, emphasising the importance of corporate reporting that goes beyond financial metrics. The Fund has strategically aligned itself with sustainability principles through various investments in the regional stock market. Many of our investee companies have begun their own sustainability journeys. This heightened awareness is supported by the ongoing implementation of structures to advance our ESG agenda.

Strategic assessment and sustainability integration

Last year, the Fund initiated a comprehensive baseline assessment of all key strategic initiatives. This included a detailed research and analysis to evaluate our current practices and identify areas for improvement, assessing our progress against various frameworks such as the UN Sustainable Development Goals (SDGs). We have already aligned with UN SDG 1,5,8,10,11,16, and 17, focusing on integrating sustainability into our overall strategy and financial reporting.

Building consensus and driving sustainability

Consensus building across the Board, management, and throughout the Fund has been pivotal. We are defining concrete actions and expectations for each department to embed sustainability principles into their operations. Moving forward, our focus is on developing specific goals, initiatives, measurable key performance indicators (KPIs), and timelines aligned with our Vision 2035. This includes a rigorous assessment of risks related to data collection and analysis, critical for mapping out our roadmap and effectively executing our ESG metrics.

Excellence in execution and ESG leadership

Recognising the complexity of our sustainability journey and the limited internal expertise, the Fund appointed an ESG Advisor. The advisor plays a vital role in accelerating our sustainability initiatives plus knowledge pass-over. The responsibilities include (but not limited to) policy development, cultural evolution, establishment of a dedicated team, ensuring excellence in execution, and evaluation of our sustainability efforts.

Evolving our sustainability governance

As a certified sustainability professional, I collaborate with Board colleagues to enhance awareness and ensure a comprehensive understanding of sustainability. Management is tasked with developing a strategic plan that encompasses sustainability ESG criteria. Once established, this plan will guide our oversight, employing appropriate tools, implementation strategies, and stewardship to accelerate sustainability initiatives.

A well-defined sustainability policy will provide the Board with a clear roadmap. This roadmap will outline what needs to be assessed, implemented, and delivered by management to achieve our sustainability goals. Once the policy is in place, management will report on sustainability initiatives with full transparency and guidance.

Oversight of sustainability is currently undertaken by our Audit and Risk Committee. Given current legal constraints, our board charter does not provide for a dedicated sustainability committee. To address this, we are actively pursuing an amendment to the board charter to formalise sustainability governance, which is essential for supporting our 2035 strategy centred on sustainable practices. Failure to establish these structures risks undermining stakeholder confidence in our ability to effectively manage sustainability initiatives.

Accelerating sustainability initiatives and strategic partnerships

Transition efforts

Fast-tracking our transition in critical environmental areas such as waste management and electricity is imperative. The Fund continues to monitor and assess its early steps in the ESG journey, aiming to recognise staff and departments adhering to these initiatives. Notably, our efforts in paper management and noise pollution management have been commendable.

ESG in performance scorecards

Accountability permeates all organisational levels, prompting the integration of ESG criteria into departmental remuneration and performance standards. Our contracts now align with ESG metrics and the PPDA Amendment Act 2021, reflecting our commitment to sustainability.

Climate action funding

The Fund started preparing for climate action funding opportunities in the past year. Once this is achieved, it could significantly support initiatives like the Carbon Academy for COP 29/30, aligning perfectly with our focus on both environmental and social well-being, particularly lives and livelihoods.

Social sustainability partnerships

NSSF prioritises improving lives and livelihoods. Securing climate action funding aligns with this focus, potentially supporting impactful corporate social investments directly linked to the Fund's 2035 strategy, particularly the livelihoods programme. This broader commitment to social sustainability also extends to partnerships with organisations like Rotary International, a global institution driving social good in health, education, and livelihoods for over a century.

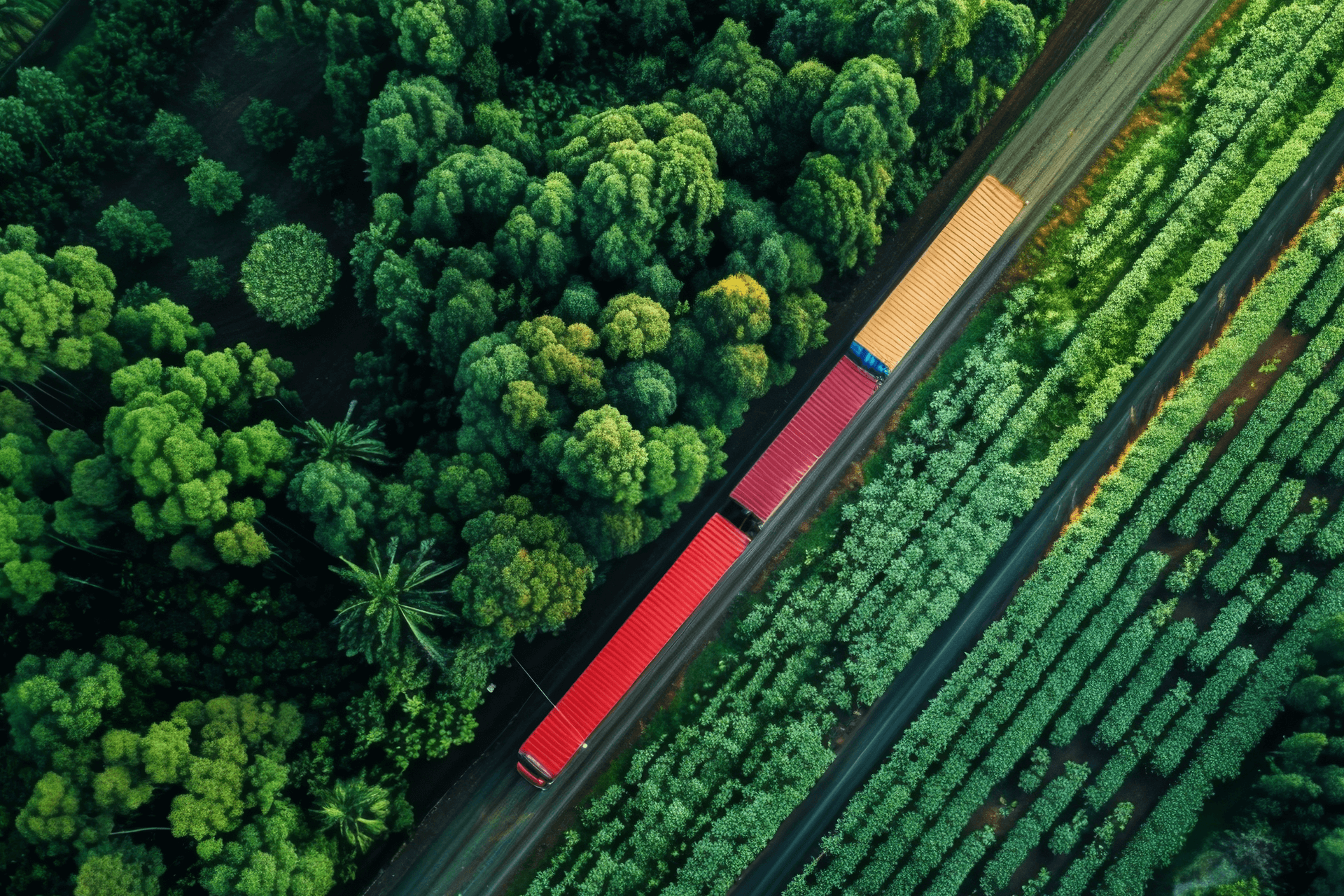

In the past year, the Fund made a strategic investment in the foundation of Uganda's economy, agriculture, by establishing the National Agricultural Marketing Company (NAMCO). NAMCO will empower farmers by connecting them with new markets and opportunities, driving job creation, food security, and financial inclusion at the household level. This paves the way for stronger families, increased resilience, and a savings culture that will secure a brighter future for generations to come.

.

Sustainability throughout the value chain

We recognise the impact our investments have on various stakeholders throughout our value chain. For example, in the case of NAMCO, we will assess whether farmers are practicing sustainable agricultural methods. We will also evaluate if their activities negatively affect the environment or society.

Similarly, for our real estate portfolio, we will assess whether suppliers are using sustainable building technologies and the carbon footprint associated with those technologies.

The Public Procurement and Disposal of Public Assets Authority (PPDA) has also emphasised the importance of integrating sustainability into public entity practices. We will adhere to these guidelines in our procurement processes.

We have engaged KPMG to provide a historical view of our investments over the last decade. This assessment will analyse the environmental impact of these investments, informing remediation and future investment decisions.

Investing in our people

Our employees are the heart of our success. This year, we expanded the Fund's Wellness Programme to prioritise their health and well-being. We also launched a mental health campaign, recognising its importance in overall staff wellness. The positive impact is reflected in employee satisfaction and the Fund's strong performance. We remain committed to ongoing initiatives that promote staff well-being and satisfaction.

Looking ahead

The Fund is committed to raising its profile as a champion for sustainability. We will continue to demonstrate the resilience, purpose, and drive that have characterised our work for the past 4-5 years. We will not back down from this challenge; instead, we will build upon our successes and forge new partnerships, both within Uganda and internationally, to champion the need for sustainable social security provision and coverage for all. By putting our members at the centre of everything we do, we believe a secure social security journey is achievable for everyone.

Dr. Peter Kimbowa, Chairman, Board of Directors

A NEW DAY - CREATING SHARED VALUE FOR SUSTAINABLE GROWTH