OUR SUSTAINABILITY:

Materiality

Material matters are those issues that could affect our ability to create value in the short-, medium- and long-term. These matters influence our strategy and how we manage our associated risks, as well as opportunities we explore because of these factors.

In 2024, we conducted a materiality assessment to identify our most relevant (or “material”) reporting topics from an ESG perspective. A survey was conducted within the Fund to gather feedback from internal and external stakeholders, providing insights into the level of engagement on ESG initiatives. It was also intended to give us a baseline to set key targets and objectives that will inform the current and future reporting cycles.

The assessment was based on a qualitative analysis of the responses received through the survey. The survey ranked the responses on a scale of 0 to 5. During analysis the double materiality concept was applied that assesses both the impact the fund has on society “outward impact” and the impact of the identified topics on the business of the Fund. The survey confirmed that sustainability continues to increase in importance to the Fund and all stakeholders.

Material ESG issues

The ESG topics identified, which we refer to as “material ESG issues” throughout this report, inform which issues we report on, which issues we consider raising to our Board of Directors and how we establish our ESG priorities. They reflect the ongoing importance of issues connected to climate change, diversity and social justice, and business ethics and governance.

Our materiality assessment focused on impact rather than activity or input. We identified key ESG topics crucial to our sustainability strategy:

Environmental:

Social:

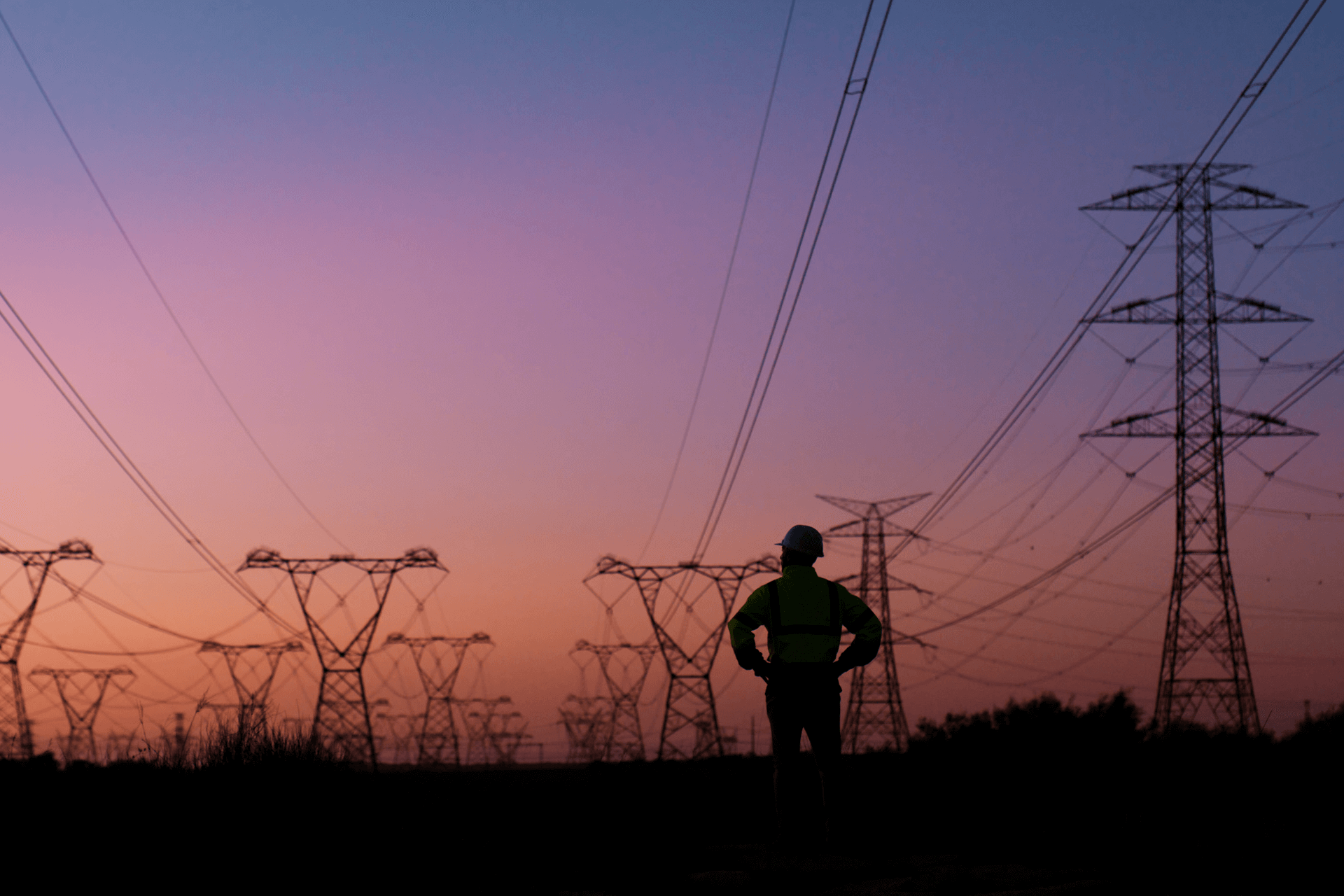

Governance:

Oversight of ESG

The Fund has appointed the Board as responsible for delivering ESG commitments. The Board is supported by the following Committees:

Responsibilities |

NSSF Board Committee oversight |

|---|---|

Social and Economic Development |

Staff Administration and Corporate Affairs Committee  Audit and Risk Assurance Committee |

Responsibilities |

NSSF Board Committee oversight |

|---|---|

Ethics |

Audit and Risk Assurance Committee |

Responsibilities |

NSSF Board Committee oversight |

|---|---|

Environment |

Investments and Project Monitoring Committee |

Responsibilities |

NSSF Board Committee oversight |

|---|---|

Stakeholder Engagement and Management |

Staff Administration and Corporate Affairs Committee |

Responsibilities |

NSSF Board Committee oversight |

|---|---|

Sustainability and Community Development |

Staff Administration and Corporate Affairs Committee |

Assurance

The Fund’s Internal Audit team plays a vital role in our ESG strategy by assessing risks amid evolving regulations.

As the ESG regulatory landscape continues to change, we have identified necessary updates to address these shifts. Our internal audit function has mechanisms in place to track ESG-related changes and assess their impact on the Fund’s processes. This objectivity ensures robust checks and balances. Given their existing experience in overseeing the Fund’s operations, Internal Audit will expand its scope over the next 12 months to review all ESG frameworks as part of its assurance activities.

Internal audit provides assurance on key areas across the six capitals:

Manufactured: IT infrastructure and real estate portfolio management

Financial: Strategy execution, financial performance, investment processes, and financial reporting

Human: Organisational restructuring, recruitment, rewards, benefits, and training

Social and Relationship: Strategic partnerships, CSI activities, and community impact

Natural: ESG frameworks and compliance

Intellectual: Brand management, data security, and IT frameworks

This comprehensive assurance framework supports NSSF in delivering value and ensuring transparency in its operations and reporting.

A NEW DAY - CREATING SHARED VALUE FOR SUSTAINABLE GROWTH