OUR BUSINESS:

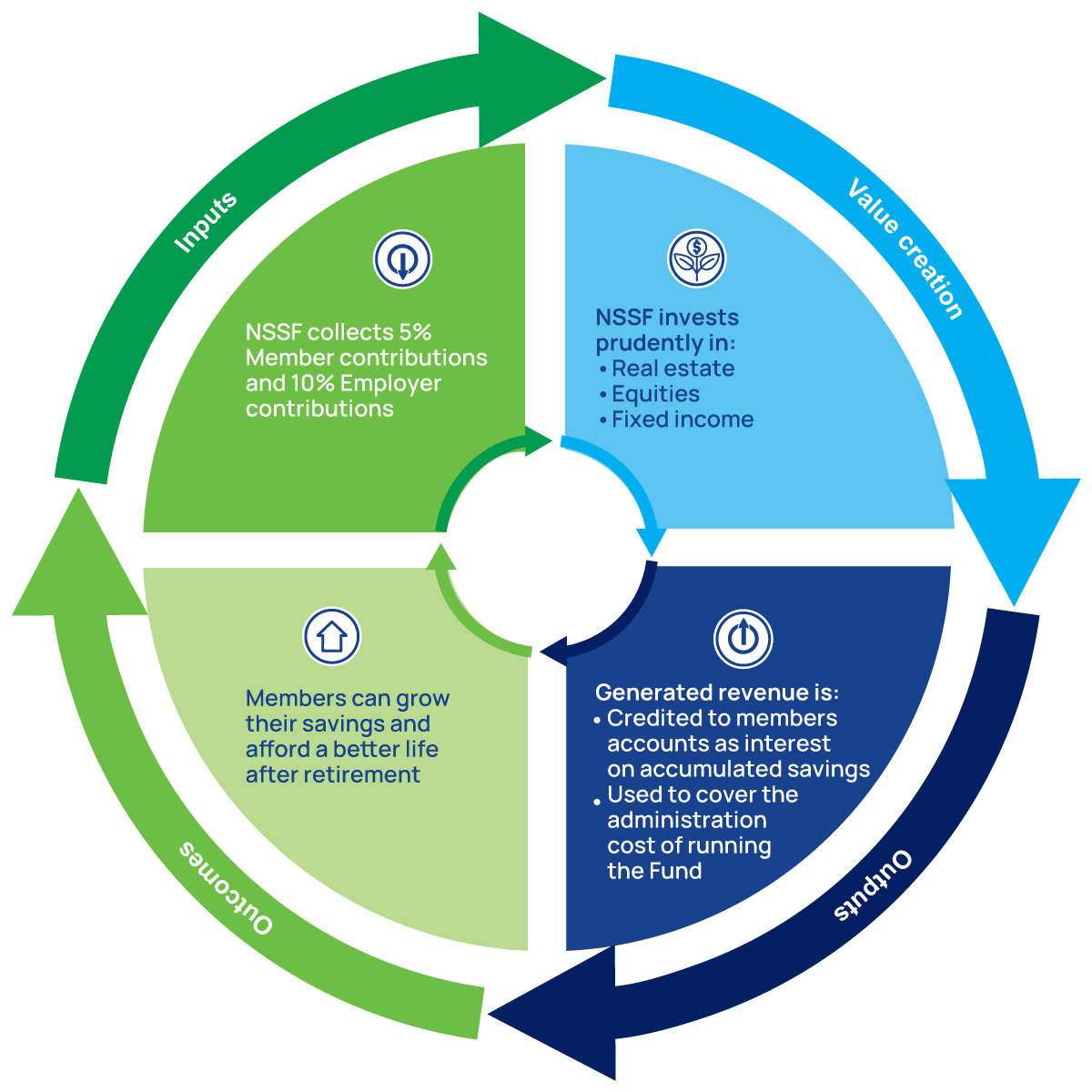

Business model and value creation aligned to the six capitals

Value Creation

Value Erosion

Value Preservation

Value Creation

Value Erosion

Value Preservation

Inputs

What we need to run our business

Financial Capital

Financial Capital

Intellectual Capital

Intellectual Capital

Human Capital

Human Capital

Manufactured Capital

Manufactured Capital

Social and Relationahip Capital

Social and Relationahip Capital

Natural Capital

Natural Capital

How we run our business

We create, preserve and defend value by using our resources responsibly to generate value maximising outputs and outcomes for our Members and all stakeholders.

Key outcomes & trade-offs

What we achieve for our stakeholders

Financial Capital

Financial Capital

Trade-offs

Intellectual Capital

Intellectual Capital

Trade-offs

Human Capital

Human Capital

Trade-offs

Manufactured Capital

Manufactured Capital

Trade-offs

Social and Relationship Capital

Social and Relationship Capital

Trade-offs

Natural Capital

Natural Capital

Trade-offs

... and ensures our ability to create value in the future.

A NEW DAY - CREATING SHARED VALUE FOR SUSTAINABLE GROWTH