OUR BUSINESS:

MATERIAL MATTERS

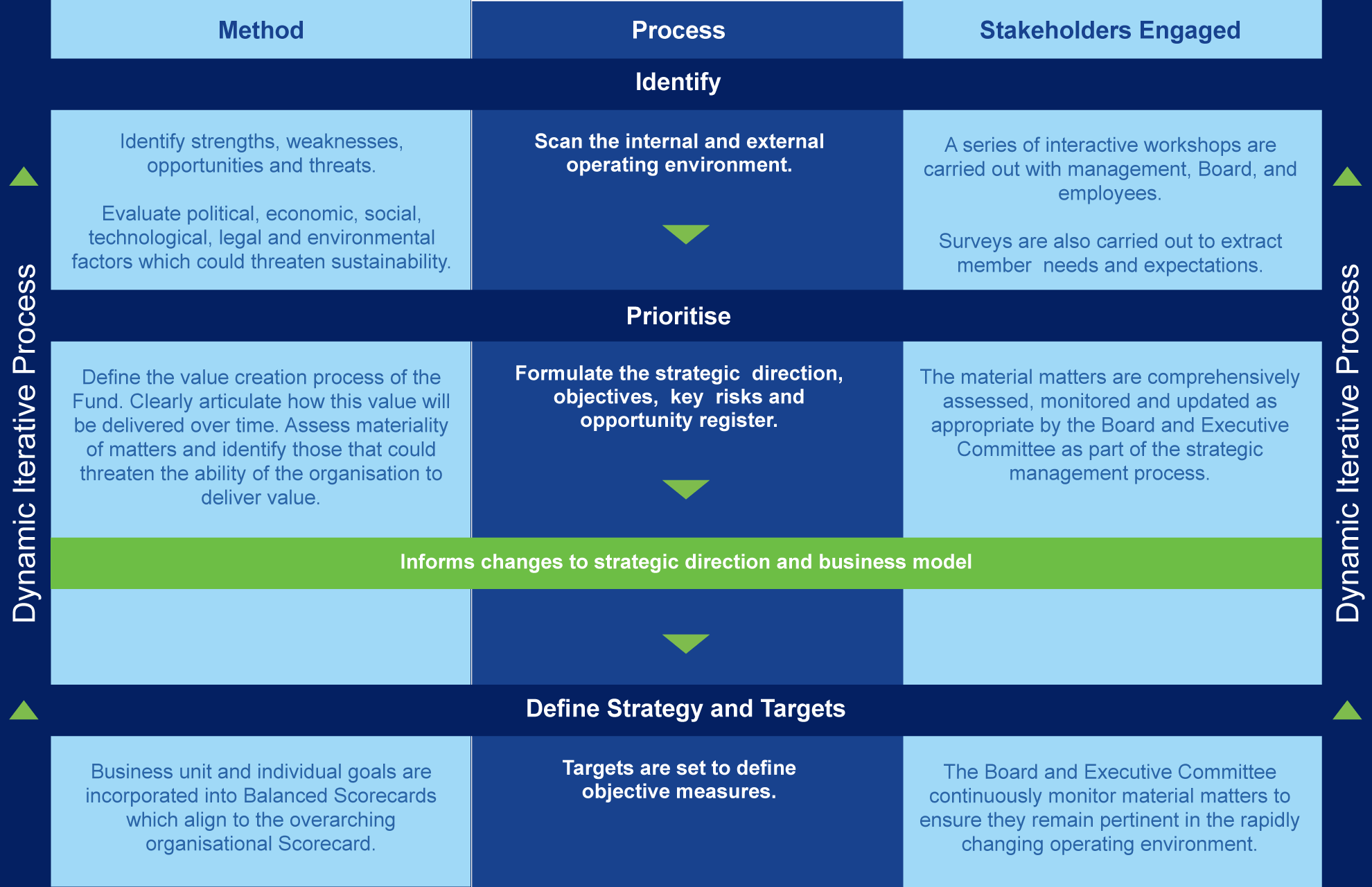

Material matters process

Material matters are issues that could significantly impact our ability to create value in the short, medium, and long term. These matters influence our strategy, how we manage associated risks, and the opportunities we explore as a result.

The process we follow to determine our material matters is as follows:

Our materiality process has prioritised the following themes. While these themes do not differ significantly from those identified in FY2023, governance-related challenges involving investigations into the Fund following negative press from the Parliamentary probe, as well as investigations by the Auditor General and Inspector General of Government (IGG), have been adequately addressed (see risks 8 and 10).

A new material matter for the Fund is the strategic execution of Vision 2035, which is critical for NSSF's long-term viability (see material matter #2).

1. Regulatory Restrictions

What it means to NSSF

NSSF faces persistent challenges in expanding its product range due to regulatory restrictions. These limitations hinder our ability to enhance our product offerings.

Short-term mitigation response

Long-term mitigation response

Opportunities and impact on the business model

Targets

Risks

Capitals

2. Strategic execution of Vision 2035

What it means to NSSF

The ambitious goals outlined in Vision 2035 are critical for NSSF's long-term viability. As our membership base ages and accesses benefits, contributions may not keep pace, potentially impacting the Fund’s and members’ financial health. To ensure a sustainable future, we must focus on three key areas:

Short-term mitigation response

Long-term mitigation response

Opportunities and impact on the business model

Targets

Risks

Capitals

3. Global economic uncertainty

What it means to NSSF

The ongoing Russia-Ukraine conflict and the resulting global economic uncertainty pose a significant challenge. Additionally, the situation in some East African countries, including potential for renewed political unrest, adds to the overall uncertainty. This volatile market environment could impact the performance of our investment portfolio, potentially leading to slower membership growth and contribution levels as economic downturns affect household income and willingness to save.

Short-term mitigation response

Long-term mitigation response

Opportunities and impact on the business model

Targets

Risks

Capitals

4. Digital acceleration

What it means to NSSF

NSSF has implemented a robust core pension system aimed at improving efficiency, enabling product innovation, and creating a seamless customer experience. However, maximising the system's potential and ensuring security requires a particular focus on:

Short-term mitigation response

Long-term mitigation response

Opportunities and impact on the business model

Targets

Risks

Capitals

A NEW DAY - CREATING SHARED VALUE FOR SUSTAINABLE GROWTH