OUR BUSINESS:

STRATEGIC TRADE-OFFS IMPACTING OUR CAPITALS

Strategic trade-offs impacting our capitals

Our business model is designed to optimise capital inputs for the best possible outputs and outcomes for our stakeholders. While we strive to make decisions that serve our stakeholders' interests, we sometimes face tough choices that require strategic trade-offs to ensure future growth and resilience.

In addition to creating and preserving value, we recognise that some activities may diminish value. When managing our business, we carefully consider these trade-offs, aiming to maximise positive outcomes and minimise negative impacts.

The trade-offs that we have made during the reporting period and the rationale for our decisions are reflected below.

Trade-offs in our use of financial capital

The investment portfolio allocation presents trade-offs: increasing investment in East Africa

We manage the Fund’s investments with the goal of achieving the highest possible long-term returns, guided by our Investment Policy Statement (IPS) and employing a range of strategies. The financial year 2023/24 was affected by unexpected global events, such as Russia's invasion of Ukraine and the global surge in inflation, which altered the economic outlook and affected investment performance.

Key actions:

Since 2023/24, the East African region, particularly Kenya, faced a challenging economic environment, leading the Fund to adopt a more conservative portfolio strategy. Consequently, we did not fully capitalise on the market recovery by June 2024. However, improved investor confidence, spurred by Kenya's successful $1.5 billion Eurobond issuance and the settlement of the June 2024 Eurobond, drove a positive shift in performance. During the financial year, we invested UGX 892 billion in Kenya through treasury and infrastructure bonds, up from UGX 583 billion in 2022/23.

Looking ahead, the Fund is exploring opportunities in alternative investments, including the oil and gas sectors and major infrastructure projects within Uganda. These initiatives will help diversify our portfolio and mitigate some of the risks associated with our current investment exposure.

Long term positive impact

Short term negative impact

SDGs

Risks

Material Matters

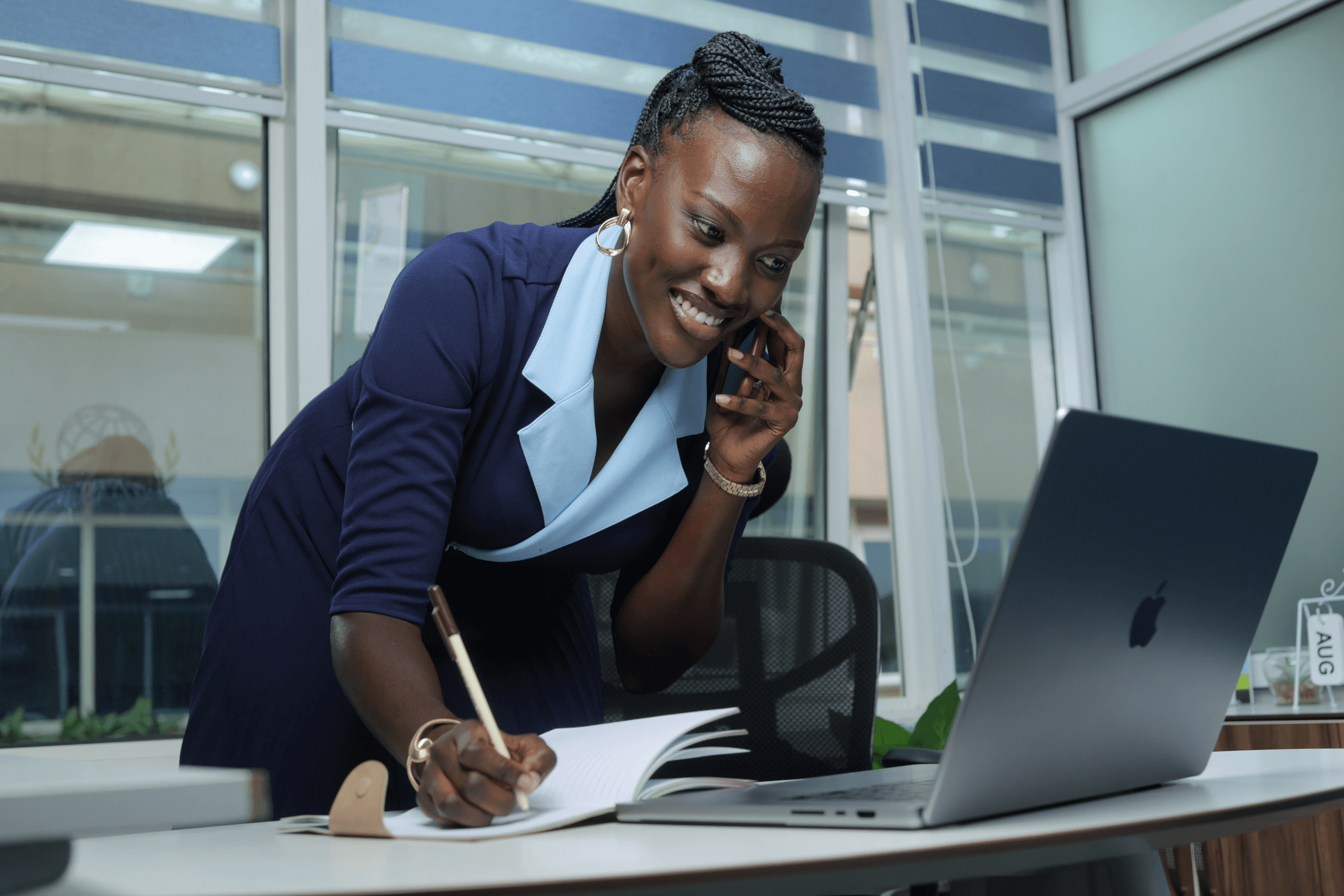

Trade-offs in our use of human capital

The organisational redesign involved trade-offs: aligning the organisational structure with the Fund’s Strategy

To remain relevant and enhance our members' experience, we continuously adapt our business model to meet evolving needs. As part of this, we set up the new Enterprise and Growth department, tasked with expanding membership coverage to at least 50% of eligible Ugandans, with a focus on voluntary membership.

Key actions:

The Fund undertook a comprehensive assessment and realignment of its business processes and employee structure to foster a more agile and skilled workforce. In line with the Board's commitment to job security, we will continue investing in reskilling programmes to address skill gaps and support employee transfers within the Fund.

Long term positive impact

Short term negative impact

SDGs

Risks

None

Material Matters

Trade-offs in our use of manufactured and financial capital

The trade-offs involved in increasing IT capacity revolve around the goal of building more resilient and agile IT systems

The implementation of the Fund’s Pension Administration system, OctoPAS, as part of our digital acceleration strategy, has created many opportunities. These include the development of new products, which required extensive business process re-engineering and the introduction of new roles such as data scientists, business analysts, and data engineers, with a focus on testing and quality assurance.

Key actions:

Long term positive impact

Short term negative impact

SDGs

Risks

Material Matters

Trade-offs in our use of financial, social and relationship capital

The trade-offs of affordable houses: Building more affordable houses for our stakeholders

Real estate is a key part of our investment portfolio. Uganda faces a housing deficit of approximately two million homes, and constructing affordable, decent housing is still costly due to high infrastructure expenses, including land, roads, water, and electricity. These fixed costs elevate real estate development expenses, affecting the final house price. Despite the societal need for affordable housing, these challenges can affect the returns on real estate projects, and the total return which we aim to maintain at least 200 basis points above the 10-year average inflation for our members.

Key actions:

During the financial year, the Fund made noteworthy progress on the construction of affordable housing in Temangalo. The feasibility study confirmed that the site will support affordable housing for middle- and lower-income segments. The project, which will eventually include 3,500 units, is progressing as planned. Phase one, featuring 550 units, is on track for completion by December 2025.

Long term positive impact

Short term negative impact

SDGs

Risks

Material Matters

A NEW DAY - CREATING SHARED VALUE FOR SUSTAINABLE GROWTH