OUR STRATEGY:

Shared value

Creating shared value through sustainable initiatives to foster shared prosperity

Driving sustainable growth through fostering shared prosperity

As a responsible corporate citizen, NSSF is committed to creating sustainable value through our corporate social investment (CSI) initiatives. These activities are aligned with ESG principles, demonstrating our dedication to environmental stewardship, social impact, and good governance. By focusing on long-term solutions and incorporating ESG considerations into our decision-making, we are striving to contribute to a better future for all.

As a responsible corporate citizen, we believe in creating a positive impact on our members, stakeholders, and society. Our corporate social investment (CSI) initiatives are designed to deliver lasting value through sustainable solutions that address social, environmental, and economic needs.

To create lasting value for our members, the Fund is committed to implementing sustainable initiatives and solutions as follows:

The Financial Literacy Programme

Our Financial Literacy Programme aims to equip our members and the public with the knowledge and tools to make informed financial decisions throughout their lives.

This initiative was launched in 2019 following a 2018 survey that highlighted a concerning trend: 90% of NSSF’s beneficiaries were depleting their savings within two years without realising long-term benefits. By promoting responsible financial behaviour, we aim to foster shared prosperity and improve the overall well-being of our members.

Read more about our Financial Literacy Programme.

Mrs. Florence Mawejje, Human resource professional engages participants during the Financial Literacy sessions on YoBenefits Count.

Hi-Innovator Programme

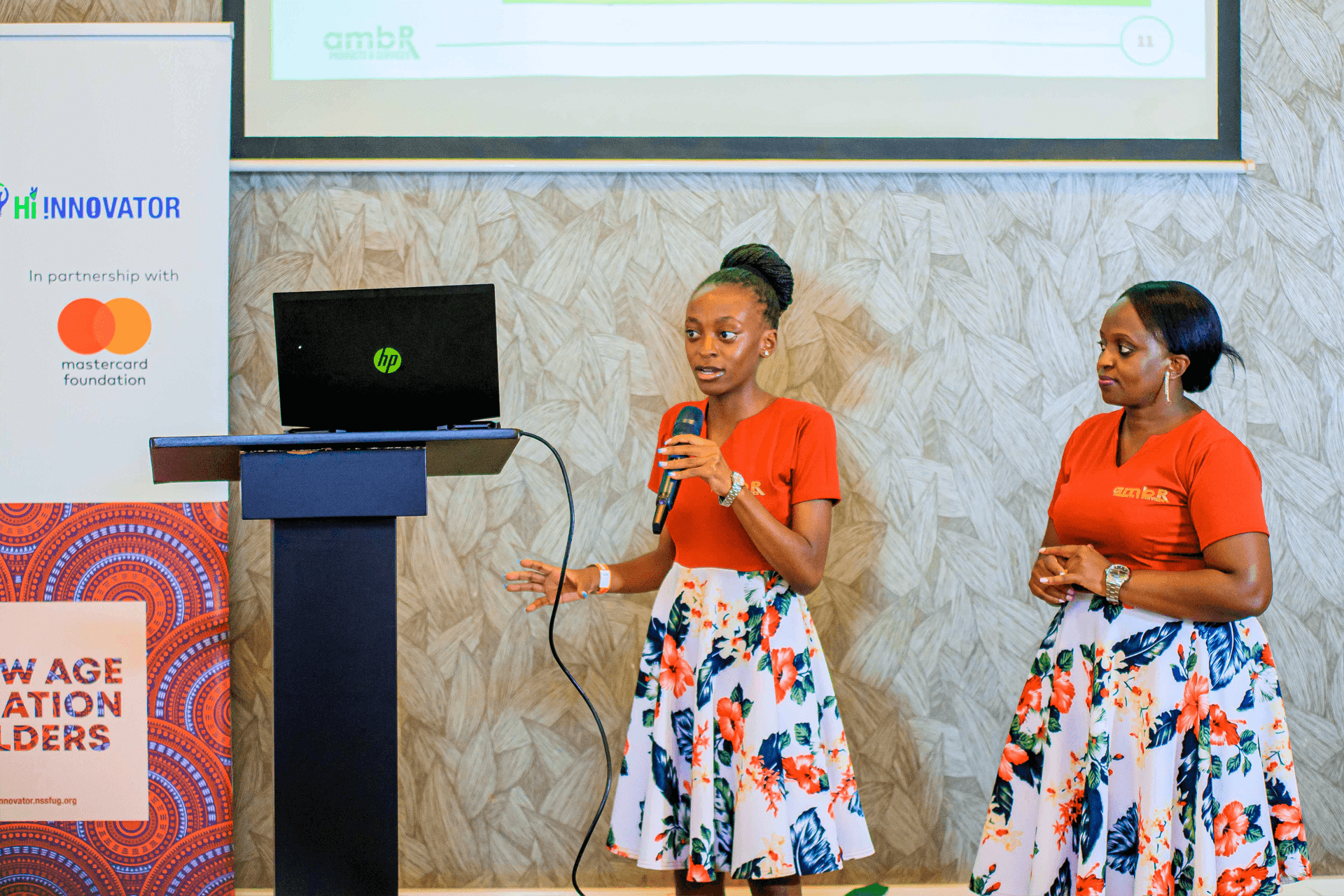

The NSSF Hi-Innovator Programme, launched in partnership with the Mastercard Foundation, is a five-year initiative dedicated to empowering youth and small and medium-sized businesses (SMBs) in Uganda. Through entrepreneurial education, funding, and technical support, the programme aims to foster sustainable growth and create employment opportunities.

Since its inception in August 2020, Hi-Innovator has focused on supporting businesses that often struggle to secure the necessary financing and resources for expansion. By providing seed funding, mentorship, and access to business networks, the programme helps entrepreneurs develop their skills, scale their businesses, and contribute to economic growth.

The Hi-Innovator Women Accelerator is a specialised component of the broader initiative, aimed at empowering women-led businesses in Uganda. This segment was developed in response to challenges such as low participation, lack of confidence, gender stereotypes, time constraints, and fear of failure among women entrepreneurs.

Internal innovation initiatives and programmes

At the Fund, we believe that innovation is the cornerstone of our success. By cultivating a culture that encourages creativity, experimentation, and continuous improvement, we can enhance employee engagement, deliver exceptional member experiences, and drive sustainable growth.

To drive sustained growth, several internal innovation initiatives are being undertaken.

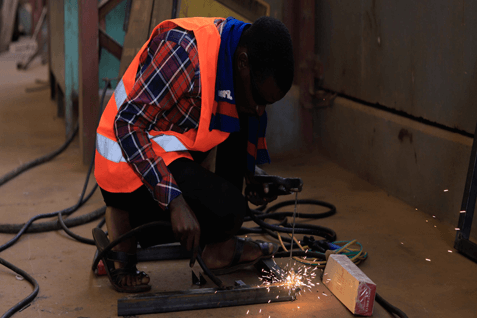

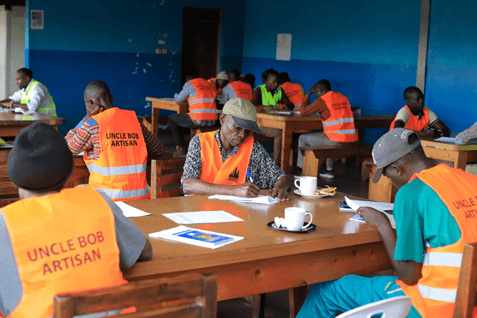

This year, our Black Swan and Trailblazers initiative has achieved noteworthy progress. By combining these two programmes, we organised interactive financial mindset workshops for artisans.These workshops, which focused on personal aspirations and financial planning, successfully shifted the mindset of participants.

Through storytelling, practical advice, and digital platforms, we empowered artisans to make informed financial decisions, save for their future, and improve their overall well-being.

Empowering members for sustainable retirement through financial literacy and entrepreneurship

The NSSF Beneficiaries Survey 2024, conducted in partnership with Enterprise Uganda, explored how NSSF benefits are utilised and perceptions toward retirement. The survey revealed that most beneficiaries spent their benefits on non-income-generating expenses, with 40% on children's education, 34% on building homes, and 33% on acquiring land. Only 28% invested in income-generating activities, such as businesses and agriculture, while 16% used the funds for food.

The report highlighted concerns that these spending patterns undermine a decent standard of living after retirement, with many beneficiaries, particularly those aged 56-60, supporting multiple dependents and remaining in full-time employment.

Crucially, the survey underscores the importance of entrepreneurship, business, and financial literacy skills for current members, as many are likely to venture into business when they receive their benefits. Enhancing these skills is essential for maximising benefits and ensuring a sustainable retirement. The survey sampled 1,129 savers, with varying types of benefits received.

Stephen Omojong – Research and Product Development Manager, NSSF during the launch of the survey Report.

A NEW DAY - CREATING SHARED VALUE FOR SUSTAINABLE GROWTH