OUR STRATEGY:

Our Members

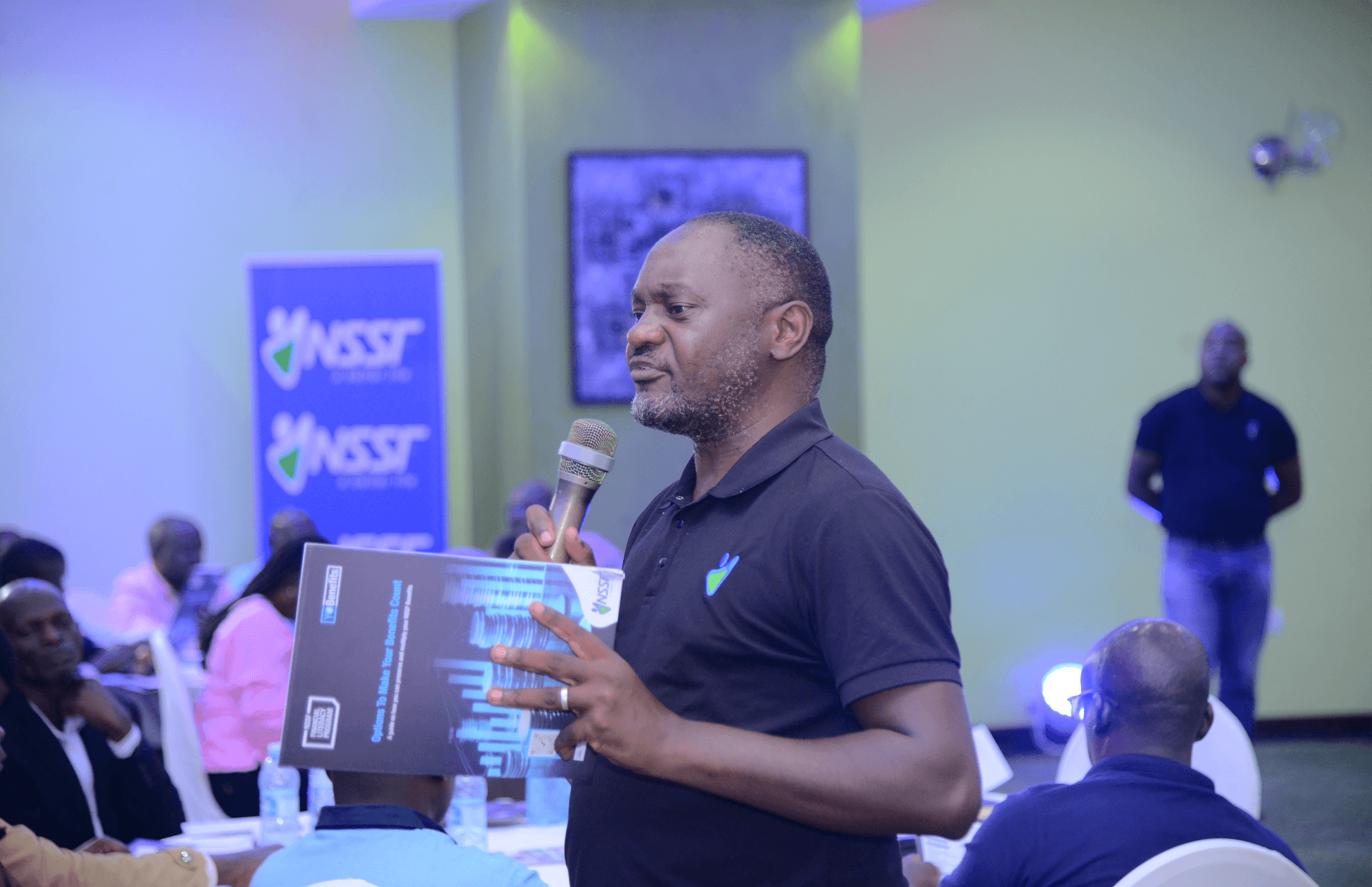

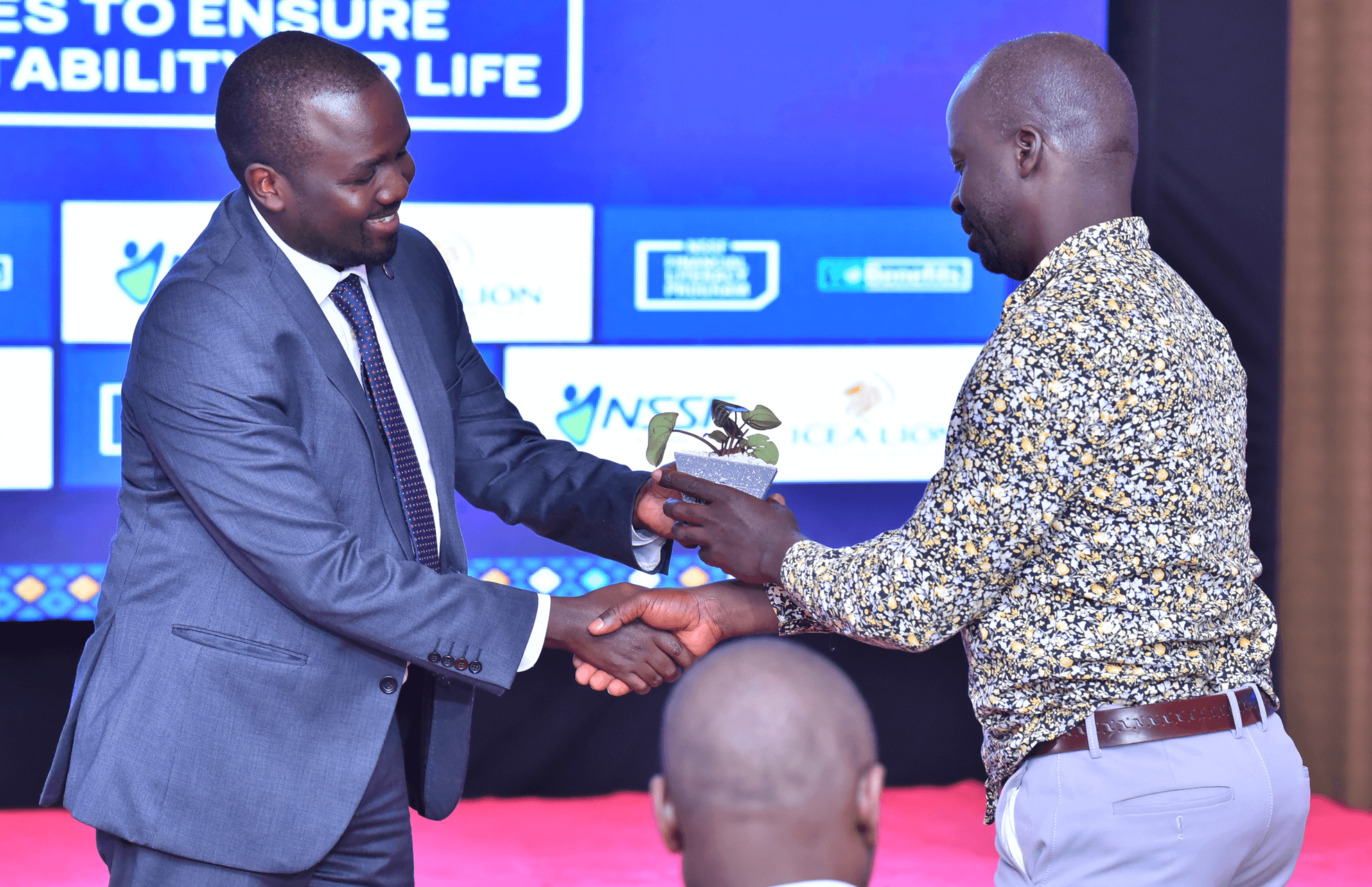

To address the growing financial challenges faced by our members, our free Financial Literacy programme offers essential guidance for building financial well-being. This year, we directly engaged 25,447 customers through initiatives such as the Make Yo Benefits Count campaign, live webinars, and town halls. We also engaged our customers in partnership with Stanbic Bank, ICEA LION Insurance, UAP Insurance, and Jubilee Insurance. We introduced an AI-driven financial literacy agent, available in English, Luganda, and Swahili, and launched our TikTok channel (@nssfug), engaging 317,955 users and reaching 3,301,378 through targeted content. Below is our Financial Literacy programme snapshot.

Financial Year |

Uptake |

Online Reach |

|---|---|---|

| FY 2023/2024 | 25,447 | 10,725,414 |

| FY 2022/2023 | 13,583 | 2,376,471 |

| FY 2021/2022 | 445,309 | 1,508,000 |

| FY 2020/2021 | 67,272 | 1,489,000 |

| FY 2019/2020 | 7,481 | 25,000 |

Customer testimonial

Mugenyi Mubarak:

How did I miss this important lifestyle discussion? 🤔 Thank you so much for this valuable information that you never learn from the workplace or school 🙏.

Videos on Financial Literacy

8. Proactive engagements with our customers

We proactively reached out to over 31,558 customers to address their complaints and benefits issues, strengthening connections and relationships. We also enhanced our automation efforts, including employer registrations and 1.37million contribution reminders.

Customer testimonial

Arnold Mka.

I received a good response from a good customer service lady this evening on my phone 📞, and I do appreciate your help. 🙏 Thanks so much! 😊

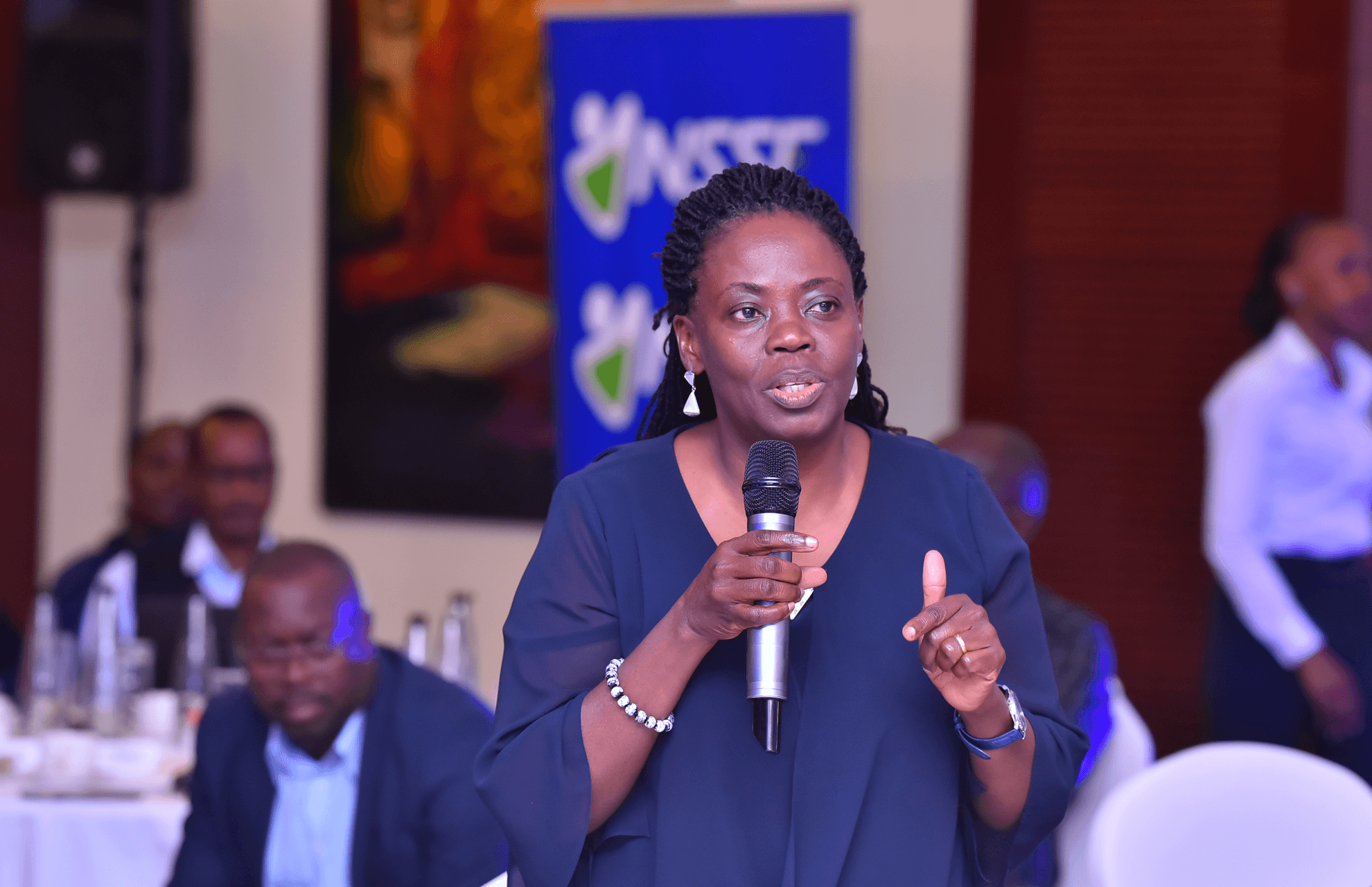

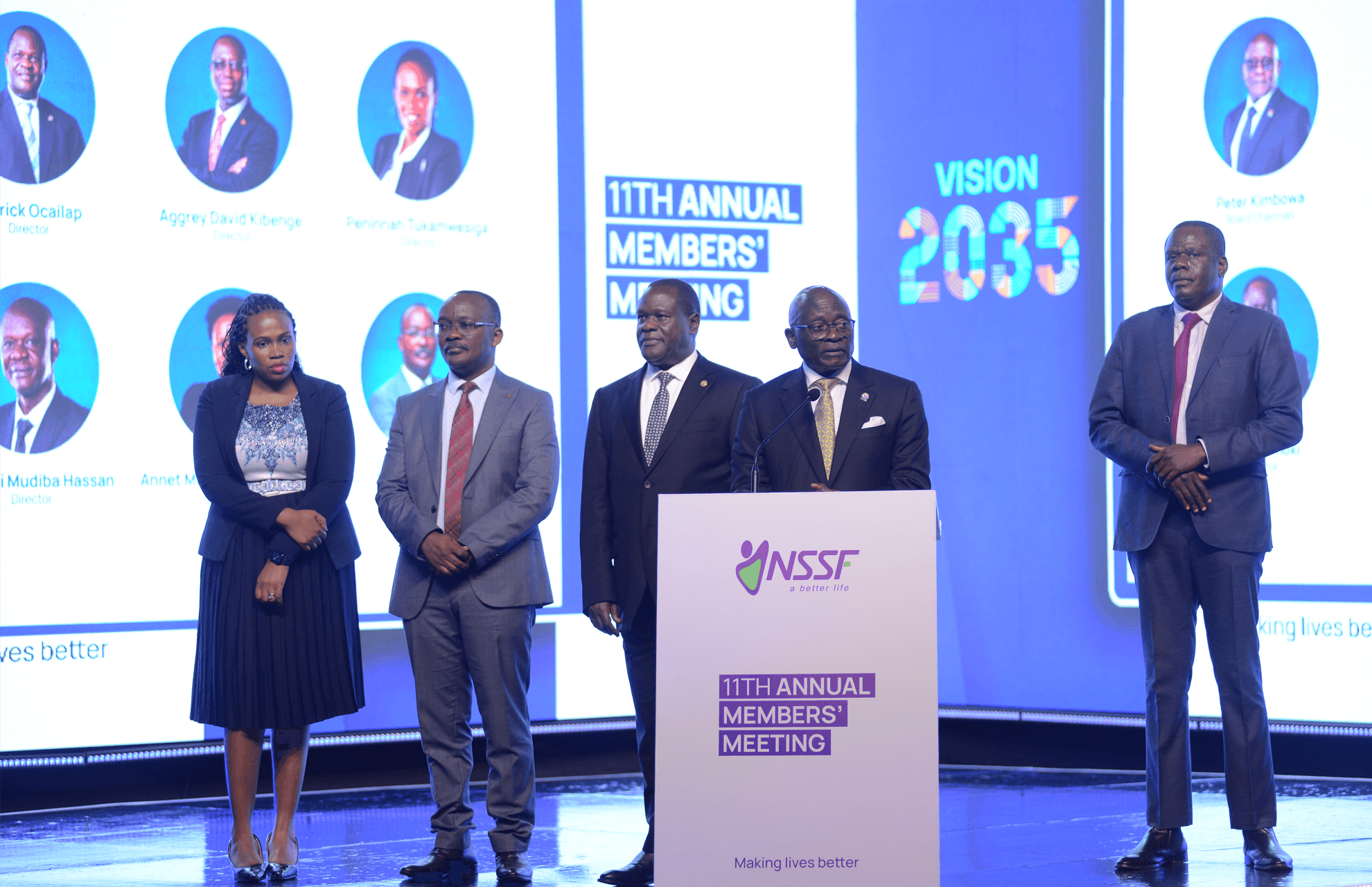

9. Annual Members Meeting

On 25 September 2023, the Fund held an interactive Annual Members Meeting (AMM) in line with our commitment to transparency and accountability to NSSF members, stakeholders, and the public. This annual event, a key highlight for the Fund, attracted NSSF partners and contributors.

The meeting featured updates from Fund management on social security trends, operations, and future initiatives, emphasising our mission to make saving a lifestyle. The Board of Directors also presented the Fund’s performance and plans for the financial year, engaging with attendees in an interactive forum.

The event was conducted in a hybrid format, accessible via our online platforms, television, and social media channels.

Achievements

Interest was computed and credited to 2,168,210 member accounts. We recorded 11,365 live views of the event, slightly down from 12,909 the previous year, and engaged more than 900,000 customers regarding interest declarations. Additionally, we achieved 3,857,963 impressions, surpassing our target of 2,000,000. The event generated 82 stories across Print, Radio, and Television, with 45% of coverage on Radio.

Customer testimonial

Naluemba Juliet

Thanks so much NSSF for being so transparent this time in what you do. We appreciate you so much! 🙏💚

10. Achievements, challenges, and ongoing improvement efforts

We are strategically leveraging members' needs and opportunities presented by the NSSF Act to enhance their lives.

By investing in innovations and forging strategic partnerships, we aim to boost members’ saving capacity and willingness. As a responsible corporate citizen, we are committed to creating sustainable value for our members, stakeholders, and society.

While we have made notable progress in certain areas, we acknowledge that we still fall short of our goals in some aspects, particularly regarding benefits turnaround time (TAT) and our people. We are actively working to address these challenges and improve our overall customer experience.

Below is an extract from the CSI report about what our members are saying:

Satisfaction Rating: QualitativeScore on a scale of 1 to 10 where 1 is VERY DISSATISFIED and 10 VERY SATISFIED on the attributes |

||

|---|---|---|

Attribute |

Rating |

Reason |

| Accessibility of funds | 7 | Inability to access funds when needed, especially during emergencies, is a source of frustration. |

| Uncertainty and trust issues | 5 | There is a level of uncertainty and concerns about the future performance of NSSF. |

| Delayed access and bureaucracy | 6 | Delays in accessing survivors benefits of deceased members due to long waiting times can be frustrating. |

| Flexibility and eligibility | 8 | Need for more flexible terms regarding benefits access, reducing the age or time restrictions for accessing a portion of their savings. |

To achieve a 95% customer satisfaction rating by 2025, we have:

11. Achievements against performance measures

We recognise the need to improve customer satisfaction, service levels, and benefits turnaround times and are actively developing strategies to achieve these goals and enhance the lives of our members.

Impact over five years |

|||||||

|---|---|---|---|---|---|---|---|

Description |

FY24 Target |

Achieved |

FY25 Target |

||||

FY20 |

FY21 |

FY22 |

FY23 |

FY24 |

|||

| Customer Satisfaction Index (CSI) | 89% | 83% | 86% | 82% | 87.5% | 87% | 95% |

| Customer Experience Index | 89% | - | 86% | 83% | 85% | 88% | 95% |

| Mystery Shopper Rating | 89% | 86% | 82% | 82% | 86% | 90% | 95% |

| Net Promoter Score (NPS) | 65 | 67 | 76 | 74 | 72 | 77 | 65 |

| Customer Effort Score | 60 | 83% | 86% | 68% | 85% | 85% | 95% |

| Customer Complaints and Resolution | 4 working days | - | 7,380 resolved in 15 working days | 15,390 resolved in 5 working days | 14,017 to 3.5 working days | 16,349 out of 16,439 resolved in 2.18 days | 1 day |

| Service Quality Score | 90% | - | 86% | 95% | 91% | 95% | 95% |

| Service Level | 80% | 81% | 86% | 84% | 86.5% | 82% | 80% |

| Benefits Turnaround Time (TAT) | 9 days | 7 days | 8.4 days | 12.3 days | 11.9 days | 10.1 days | 1 |

| E-channels to Walk-in Ratio | 90 to 10 | 84 to 16 | 94 to 6 | 93 to 7 | 94 to 6 | 91 to 9 | 95 to 5 |

12. Looking ahead

We understand that customers seek solutions to their problems, not just our products. Therefore, we are committed to developing smarter solutions and connectivity services that deliver real outcomes.

Our focus moving forward includes:

Maintaining and enhancing customer satisfaction:

We will strive to keep experience and satisfaction levels high and continually personalise the customer experience.

Supporting new products and services:

In the short to long term, we will focus on rolling out new offerings related to voluntary savings, leveraging customer needs and opportunities from the NSSF Act Cap 230.

Improving processes and promoting digital channels:

We will enhance our processes and solutions while encouraging the use of digital channels to improve convenience and interactions.

Conducting a KYC campaign:

We will initiate a campaign for customers to update their global identifiers, such as National ID Numbers, refugee, and passport numbers as part of improving service delivery.

A NEW DAY - CREATING SHARED VALUE FOR SUSTAINABLE GROWTH