OUR BUSINESS:

Risk and Opportunity management

The FY2024 was characterised by persistent geopolitical tensions that disrupted global economic recovery and intensified risk complexities. This evolving environment has introduced new challenges, impacted economic momentum and shaped a dynamic risk landscape. NSSF remains committed to proactive risk management and seizing opportunities to ensure the long-term security of our members.

Edward Senyonjo, Chief Risk Officer

Balancing risk and return

Balancing risk and return is crucial for success, as higher risks can yield greater rewards but also significant losses. We manage this delicate balance using our risk appetite framework, which has consistently supported our strong financial performance. We view risk management as integral to our operations and shared by all key stakeholders. This fosters a cohesive culture that enhances stakeholder value.

Risk appetite statement

"The Fund exercises prudence in pursuing opportunities, avoiding risks that could significantly erode member value or harm our reputation."

This statement guides our decision-making, setting boundaries and establishing risk tolerance limits based on forward-looking assumptions. We proactively assess risks before implementing new systems, products, or processes to ensure alignment with our risk appetite and minimise potential negative impacts on member value and reputation.

Risk intolerance limit

The amount or type of risk that is above the Fund’s tolerance limits

If a risk exposure falls in this area, we are in breach of the tolerance limit

Risk tolerance limit

The amount or type of risk that the Fund is prepared to tolerate above its risk appetite

If a risk exposure falls in this area, we are in breach of risk appetite but within tolerable limit

Risk appetite

Level or nature of risk that the Fund deems acceptable in pursuit of business objectives

If the risk is within this area, it is within our risk appetite

Party

Accountability

Board of Directors: The Board oversees the Fund’s overall risk management strategy, ensuring effective enterprise risk management and compliance with relevant policies, laws and regulations.

Audit & Risk Assurance Committee (ARC): The ARC ensures the integrity of financial reporting, the effectiveness of internal controls, and compliance with policies, laws and regulations. It reviews risk reports from management and advises on the adequacy of the Fund’s risk management strategy.

Executive Committee (ExCo): Management handles risks and opportunities within the Board-approved risk appetite to create value, ensuring alignment with strategic objectives and effective risk management.

Risk Management Committee (RMC): The RMC evaluates the effectiveness of the enterprise risk management strategy and activities, providing guidance to the Chief Risk Officer on managing risk exposures.

Enterprise Risk Management (ERM) department: The ERM department is crucial in coordinating the risk management process across the Fund and delivering risk awareness training and sensitisation throughout the Fund.

Risk Owners: Risk Owners are employees directly responsible for managing risks effectively by implementing actions to mitigate them.

Combined assurance

Combined assurance integrates activities across the three lines of defence, aligning with our business model and risk appetite. This strategic approach enhances risk management, mitigates risk exposures, and maximises opportunities for stakeholders in the medium and long term.

1ST Line of defence

Operational management

2nd Line of defence

Risk and compliance

3rd Line of defence

Internal audit

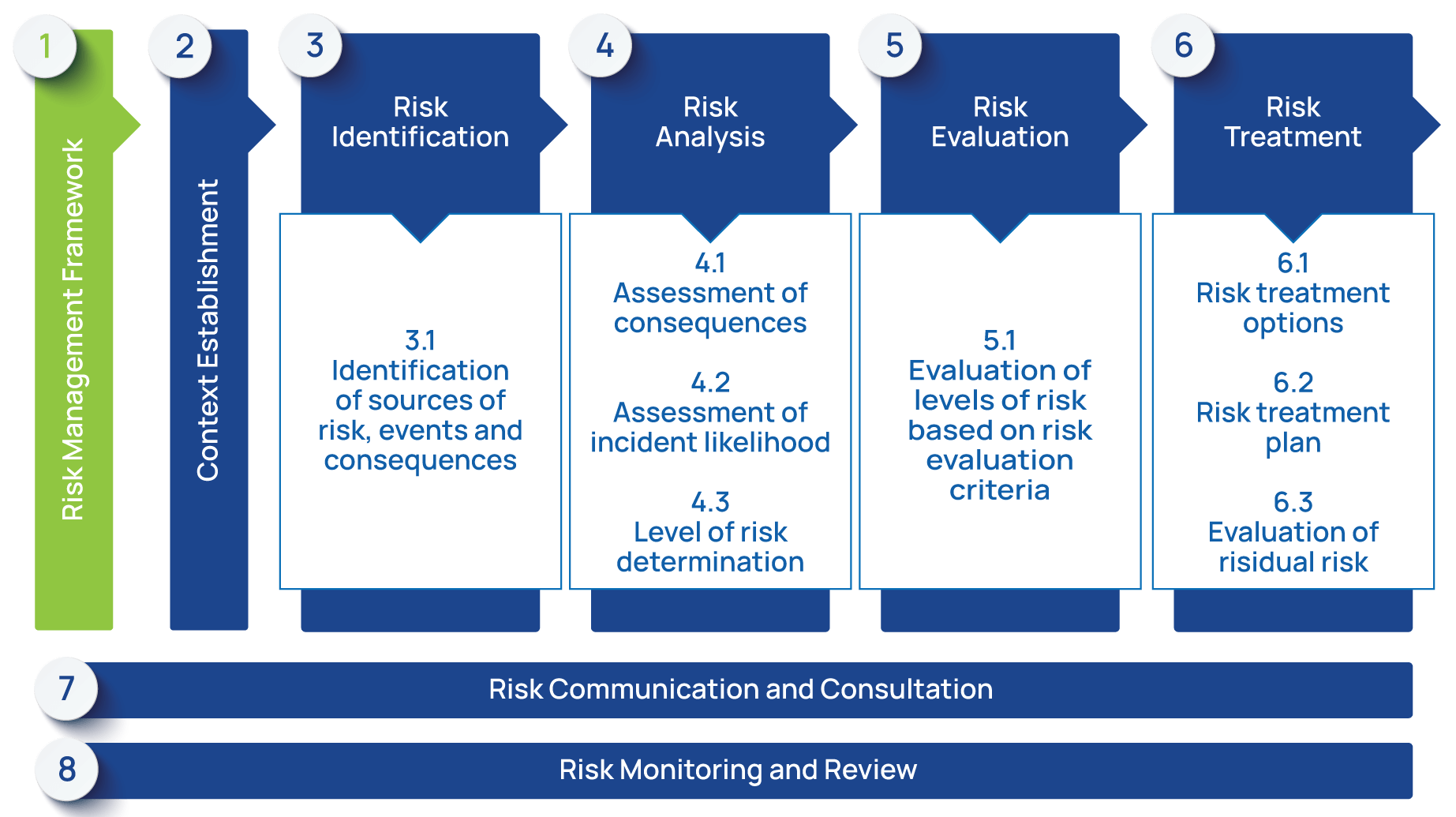

Risk assessment process

A NEW DAY - CREATING SHARED VALUE FOR SUSTAINABLE GROWTH