OUR STRATEGY:

Our Members

Delivering a greater customer experience

NSSF Customer Snapshot

FY 2023/2024

FY 2022/2023

Enhanced:

Enhanced:

Enabled:

Enabled:

Enhanced value through:

Enhanced value through:

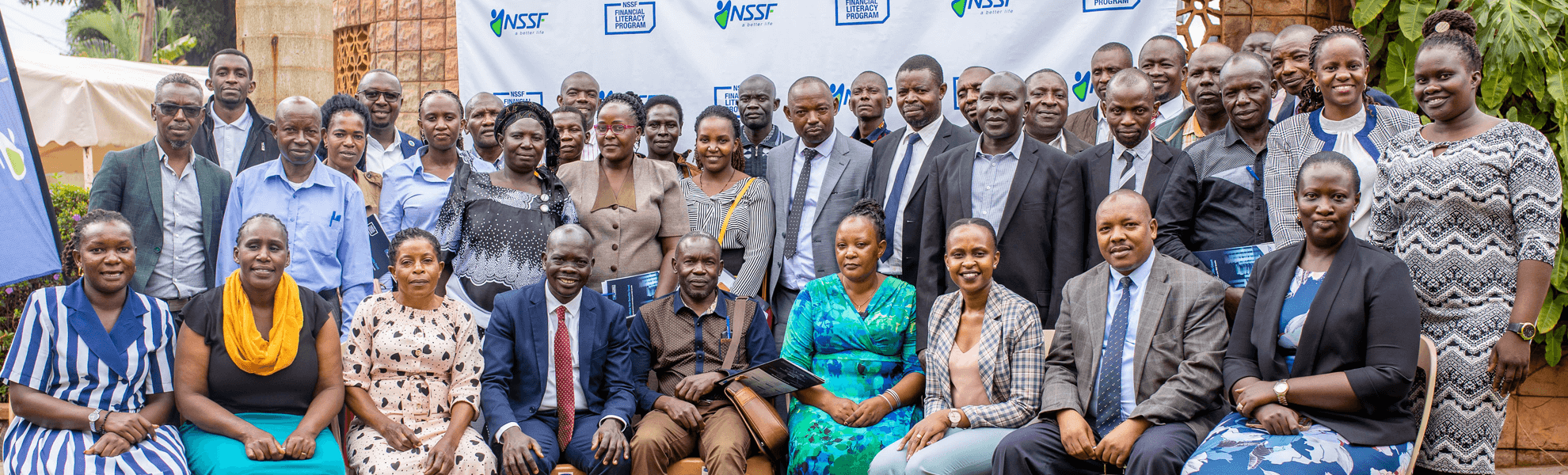

Image: Our customers pose for a group photo after the Financial Literacy Session hosted by NSSF Mukono Branch.

We create value by building strong connections with our customers and the public, ensuring positive experiences in all interactions to make saving a way of life. We invest in innovations to provide accessible, empathetic, and inclusive services, especially for those facing challenges accessing Fund services or with complex needs.

We engage customers through various channels, including digital solutions, contact centres, branch networks, outreach centres, and Relationship Managers. Our Member Services Section, which includes Customer Experience, Benefits and Data, and Service Quality Units, helps us turn resources into valuable outcomes that meet our strategic goals and benefit our customers.

We focus on different segments to build connections and provide tailored solutions for outstanding customer experiences, generating revenue and building long-term trusted relationships. We are dedicated to:

To enhance customer connections and experiences, we conduct regular surveys, analyse complaints, interact directly, and use data from customer transactions. While we are making progress in improving our service levels, we recognise and are always ready to address areas that need improvement to meet our mandate.

Our key material areas to creating value for our customers

Key member and customer concerns |

Material areas |

…to achieve the following value |

|

|---|---|---|---|

For our Customers |

For our Fund |

||

Key developments in FY 2024

1. Member services performance

During the year, we embraced fast, effective customer experiences by fostering an environment that encourages curiosity, digital thinking, and continuous improvement. Leveraging innovation and our commitment to delivering high-quality services, we are poised to empower individuals, businesses, and communities across Uganda and internationally. Our improvements and innovations have enhanced both our operations and the customer experience.

Customer testimonial

Tobias Anok

I checked in ✔️ at NSSF Headquarters last week, man, I was welcomed like a big person... Those people, from the entrance to your destination and back, are the true definition of public officers.

2. Customer education on digital channels and DIY

We emphasised educating our customers about our online platforms and promoting a Do It Yourself (DIY) approach to enhance accessibility and usability. Our "Chap Chap" promotion, launched this year, encouraged customers to use our self-service channels anytime and anywhere. This initiative led to a 55.9% increase in digital channel usage, achieving the following outcomes:

Digital Index |

Target |

Actual |

|---|---|---|

| Our Online Sentiment | 65% | 74% |

| Our Penetration | 40% | 55.9% |

| Our e-channel: Walkin Ratio | 90% | 91% |

3. Enhanced our online channels and processes

We continued to enhance our processes and systems to improve efficiency and customer experience. These enhancements include upgraded our NSSFGo App for easier access to services and stabilised our email and tollfree Interactive Voice Response (IVR) to reduce turnaround times, and cost-saving measures. These improvements support better self-service options for our customers, improving our customer experiences and processes.

Customer testimonial

Alecoo B'ruhanga T

The NSSF App is now user-friendly, thanks for the upgrade! 😊👍📱

4. Online benefits claim application

This year, 18,489 (44.8%) customers used our NSSFGo mobile app, web app, and digital forms to apply for benefits. We also introduced an Emigration Grant portal for non-Ugandans. The online application system has streamlined verification processes, cutting benefits turnaround time and printing costs. This improvement enhances self-service options for members and speeds up service at walk-in centres.

Customer testimonial

Ronnie Namugera

Thanks @nssfug, this efficiency is incredible, and there's no need to sign here or there! ✍️❌ Online claim application responded to within 48 hours. ⏱️👏 Let's share this positive performance more often. Well done! 🙌

5. Enhanced whistleblower platform

Since launching our enhanced Whistleblower Portal, we have received reports from 2,650 customers about non-compliant companies. The improved portal, accessible via the NSSF website and NSSFGO App, is interactive and ensures anonymity, allowing easy reporting of non-compliant employers. Of the reports, 35% (928 cases) resulted in audits or demands for payment of employee contributions. The portal tracks and addresses cases until resolution and allows Government Labour Inspectors to report employers failing to remit mandatory contributions. We encourage everyone to use this portal as part of our digitisation strategy for efficient self-service.

6. Member benefits processed and paid

In the past year, we processed benefits for 42,901 customers, a decrease from 46,337 the previous year. We disbursed UGX 1.12 trillion, with an improved average processing time of 10.1 days, down from 11.9 days. Our benefits payouts improve our customers' quality of life and help them achieve financial stability.

FY |

Members Paid |

Amount Paid |

TAT (In Days) |

|---|---|---|---|

| 2023/2024 | 42,901 | UGX 1.12 trillion | 10.1 |

| 2022/2023 | 46,337 | UGX 1.2 trillion | 11.9 |

Customer testimonial

Pascal Bisimiwa

Good morning Dear NSSF team. I am back to you to inform that I have received the payment from you.I humbly submit my thanks 😊 to all the lovely team for the great work, especially to Lawrence, Aaron, and others that I don't know who contributed for this case to be issued. Thank so much 🙏.I can't fail to thank the government of Uganda for whatever it’s doing to and for refugees. Only GOD will pay Uganda and Ugandans for their kindness. Be blessed.

Florence Baingana

🐦A huge positive shout out to @nssfug. The process to withdraw benefits was seamless, painless, efficient and fast!!! #recognizingexcellence.

A NEW DAY - CREATING SHARED VALUE FOR SUSTAINABLE GROWTH