OUR STRATEGY:

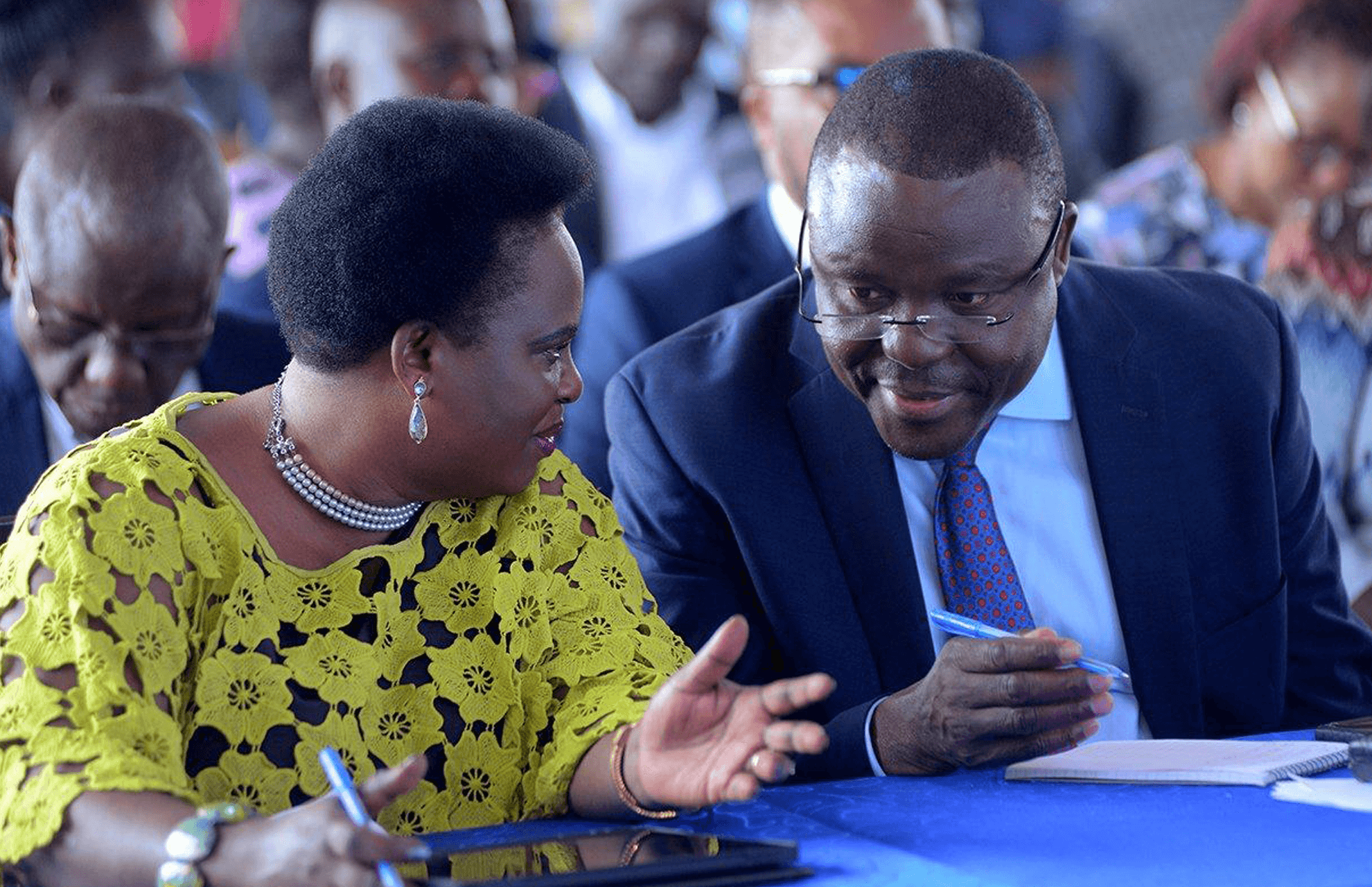

Our Regulators and Government

During the last financial year, we actively engaged with our regulators and government to address members' needs and leverage opportunities from the NSSF Act. Our goal was to develop strategies that enhance members' lives throughout their journey while driving sustainable value for both the Fund and society.

Operating in a complex and heavily regulated environment, we recognise that changes in laws or regulations can impact our business. To mitigate these effects, we collaborate closely with regulators and government bodies to alleviate regulatory pressures and protect our customers and stakeholders. It is crucial that we engage with these key stakeholders across all aspects of our operations, using various communication channels to ensure effective and proactive management.

Our regulators include government, Parliament of Uganda, Ministry of Gender, Labour and Social Development (MGLSD), Ministry of Finance, Uganda Retirement Benefits and Regulatory Authority (URBRA), Public Procurement and Disposal of Public Assets (PPDA), Solicitor General, Attorney General and Uganda Revenue Authority (URA), Capital Markets Authority (CMA), National Environmental Management Authority (NEMA), Financial Intelligence Authority (FIA) and Bank of Uganda among others.

Our regional investments in Kenya, Tanzania, and Rwanda further expand our regulatory landscape. We consistently engage with these regulators to manage and adapt to regulatory changes, maintaining productive relationships to foster a stable business environment.

By working closely with policymakers and regulators, we aim to:

Mitigate legislative and regulatory

risks

Maximise the impact of local investments

Enhance our thought leadership on public policy

Strengthen our position as a preferred technology and employer partner

Through these efforts, we build mutually beneficial partnerships and ensure effective regulatory compliance, benefiting both the Fund and our broader ecosystem.

Our engagement with these regulators extended throughout the year, with clear expectations of the intended outcomes. Any breach of regulations could expose NSSF to significant financial, operational, and reputational damage. Therefore, maintaining productive, two-way engagement with regulators and supervisors is crucial for a stable business environment and effective management of regulatory changes.

Quality of relationships

We strengthened our focus placed on ensuring robust governance processes and strong regulatory compliance. We took bold steps to shift our reputation in a positive direction. This is so because we remain committed to achieving our mandate and that we continue to place special focus on strengthening corporate governance and ethics, and stability of the Fund. As a result, we scored a media tonality of 92.1%.

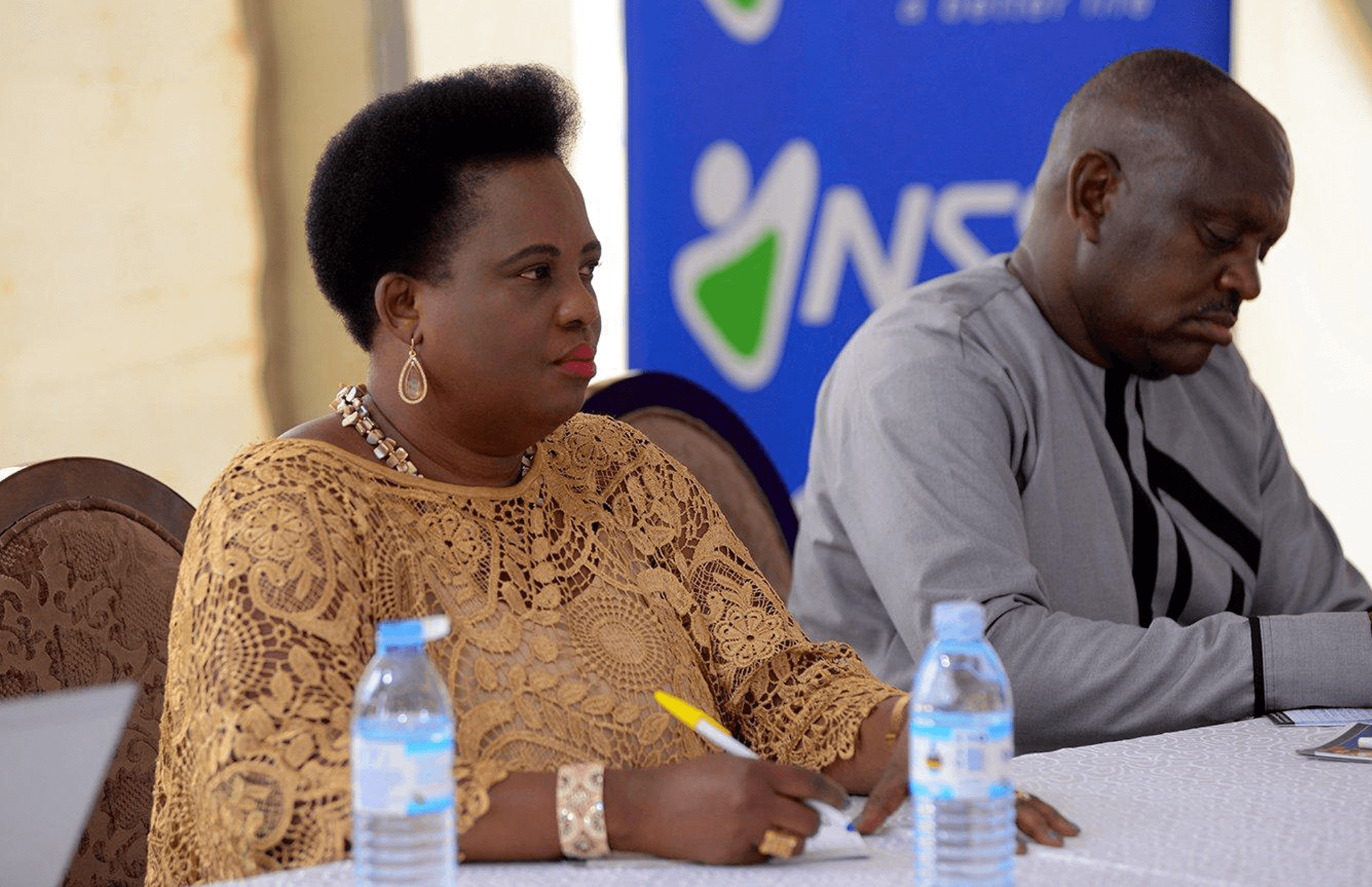

Our Fund supervisors

Several Fund activities require regulatory authorisation, guidance, licensing, and/or registration with key regulators. During the reporting period, the Fund remained committed to adhering to relevant regulatory requirements, ensuring that our activities are authorised, controlled, supervised, and regulated.

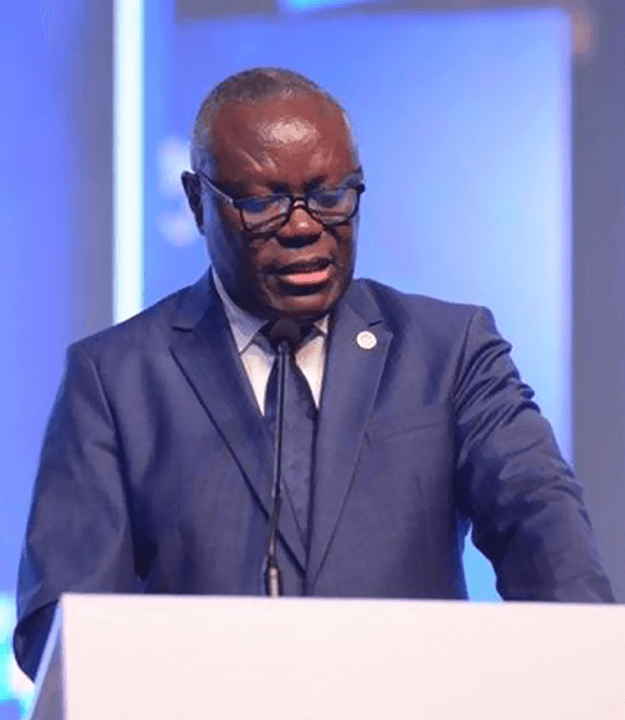

Our senior leaders and Board dedicate substantial time representing NSSF to regulators, policymakers, and other stakeholders. This engagement allows us to understand their needs, expectations, and priorities while keeping them informed about our business developments.

Additionally, our business and control functions interact with regulators through various channels, including compliance reporting, policy recommendations, and participation in industry initiatives and ad hoc requests. This interaction has enhanced our ability to ensure the safety of the pension system and demonstrates our commitment to continuous improvement in fulfilling our mandate.

The Ministry of Gender, Labour, and Social Development (MGLSD) supervises social security matters, while the Ministry of Finance and Economic Development oversees financial, and investment aspects related to the Fund.

We continue to collaborate with the Ministry of Gender, Labour, and Social Development (MGLSD) on corporate governance, leadership, budget guidance, partnership development, and regulatory issues related to the NSSF Act (Caps) 230. Our focus is on expanding sector coverage and increasing compliance.

We contributed to discussions on emerging regulations for voluntary savings in the informal sector. This engagement led to the drafting of Voluntary Savings regulations, with input from MGLSD, the Attorney General’s Office, and other key stakeholders.

Supported by MGLSD, we participated in industry forums and trained District Labour Officers on inspecting and reporting employer defaults on customer remittances. We also engaged with key sectors such as ICT and Oil and Gas to enhance compliance. Our partners, including the National Organisation of Trade Unions, Central Organisation of Free Trade Unions, and the Federation of Uganda Employers, are actively involved in this process.

URBRA continuously monitors our products and services to ensure compliance with laws and regulations. Our investment decisions adhere to the NSSF Act, URBRA Investment Guidelines, and internal policies.

We have implemented internal procurement policies to meet new regulatory requirements, including the PPDA amended regulations 2023. Our expertise is actively engaged in highlighting key positives and best practices in the Fund’s procurement and disposal processes. The PPDA rated our performance at 84.6%, recognising us as one of the best performing public entities in Uganda.

Protecting our customers’ financial data

Protecting our customers’ personal and financial information remains a top priority. We continuously enhance our internal controls, policies, and security measures through a comprehensive approach that includes technological, administrative, organizational, and physical safeguards. Additionally, we have partnered with the Financial Intelligence Authority (FIA) to strengthen our understanding of money laundering trends and Know Your Customer (KYC) requirements, integrating these insights into our risk management framework.

Our approach to tax growth

We recognise that tax sustains and safeguards long-term growth value and enhances the reputation of communities in which the Fund operates. Additionally, it contributes to delivering greater stakeholder value. In the financial year, we continued to act lawfully and with prudence in our responsibility to comply with tax statutory obligations and disclosure requirements. The Fund maintained open and constructive relationships with the Uganda Revenue Authority (URA).

Our tax contributions for the reporting year, were as follows:

> UGX 216Bn |

> UGX 25Bn |

|---|---|

| Tax expense | Tax recovered from government |

A NEW DAY - CREATING SHARED VALUE FOR SUSTAINABLE GROWTH