OUR BUSINESS:

Risk and Opportunity management

Overview of the 2023/24 risk landscape

Despite starting the FY2023/24 with heightened regulatory compliance risks due to several investigative reviews by regulatory agencies, the Fund achieved strong performance, as reflected in the financial statements.

The Fund's image, previously impacted by negative press, significantly improved from 56% in July 2023 to 93% by 30 June 2024, according to media tonality measurements. The NSSF risk landscape has been shaped by various global, regional, and local factors.

Global factors

The escalation of the Israel-Hamas conflict, which began with Hamas's attack on Israel on October 7, 2023, followed by Israel's extensive bombardment of Gaza, alongside the ongoing Russia-Ukraine war, is likely to disrupt the global oil and gas supply chain. This disruption is expected to lead to higher oil prices and contribute to increased global inflation.

Regional factors

During the period under review, the East African region experienced heightened geopolitical tensions, including escalating conflicts led by the M-23 and Allied Democratic Forces (ADF) in Eastern DRC. These conflicts disrupted trade among DRC, Rwanda, and Uganda and resulted in significant loss of life. Additionally, violent protests against the Finance Bill in Kenya in June 2024, which led to 23 deaths and property damage estimated at Kshs 2.4 billion, may deter foreign investors in the short to medium term.

Social and environmental factors

East Africa is highly vulnerable to climate change, experiencing extreme weather such as heavy rains leading to flooding and prolonged dry spells causing water and food shortages. These conditions severely impact human and animal lives, especially children and the elderly.

The CDP (Carbon Disclosure Project) 2024 report highlights significant flooding from intense seasonal monsoons and heavy rains in Kenya, Ethiopia, Uganda, Tanzania, Burundi, and Somalia. Approximately 1.6 million people were affected, with 473 fatalities and over 410,000 displaced by these extreme weather events.

Uganda, Kenya, and Ethiopia continue to host substantial numbers of refugees, particularly from conflict-affected regions like South Sudan, DRC, Somalia, and Eritrea. As of March 31, 2024, Uganda alone had 1,611,732 refugees, according to UNHCR statistics.

The influx of refugees strains the host countries' resources and complicates the delivery of essential services such as housing, education, and healthcare.

Macroeconomic factors

Economic growth reached 6% in the year, surpassing the previous year's 5.3% (Budget Speech Year 2024/2025). This robust growth contributed to increased contributions to NSSF from UGX1.72 trillion in 2022/3 to UGX 1.93 trillion 2023/4.

Inflation

The low level of inflation enabled the Fund to improve its cost of administration from 1.03% in 2022/23 to 1.0% in 2023/24. Inflation remained low at an average of 3.2% in the 12 months to May 2024 (Budget speech FY 2023/24). Annual headline inflation reduced from a peak of 10.7% in October 2022 to 3.6% in May 2024.

Interest rate

Interest rates in the domestic market remained generally stable, averaging at 11.2% on the one-year government treasury bills. Interest rates on the 20-year, 15-year, 10-year and 5-year bonds averaged at 15.87%, 16.40%, 15.53% and 14.72%, respectively. As a result, the Fund’s interest income grew from UGX 2.04 trillion in 2022/23 to UGX 2.24 trillion in 2023/24.

Exchange rate

The Uganda shilling depreciated against majority of the foreign currencies through most of the year and traded at an average of 3,771 against the USD. The depreciation of the UGX against the KES enabled the Fund to reverse the unrealised foreign currency losses registered in the previous year.

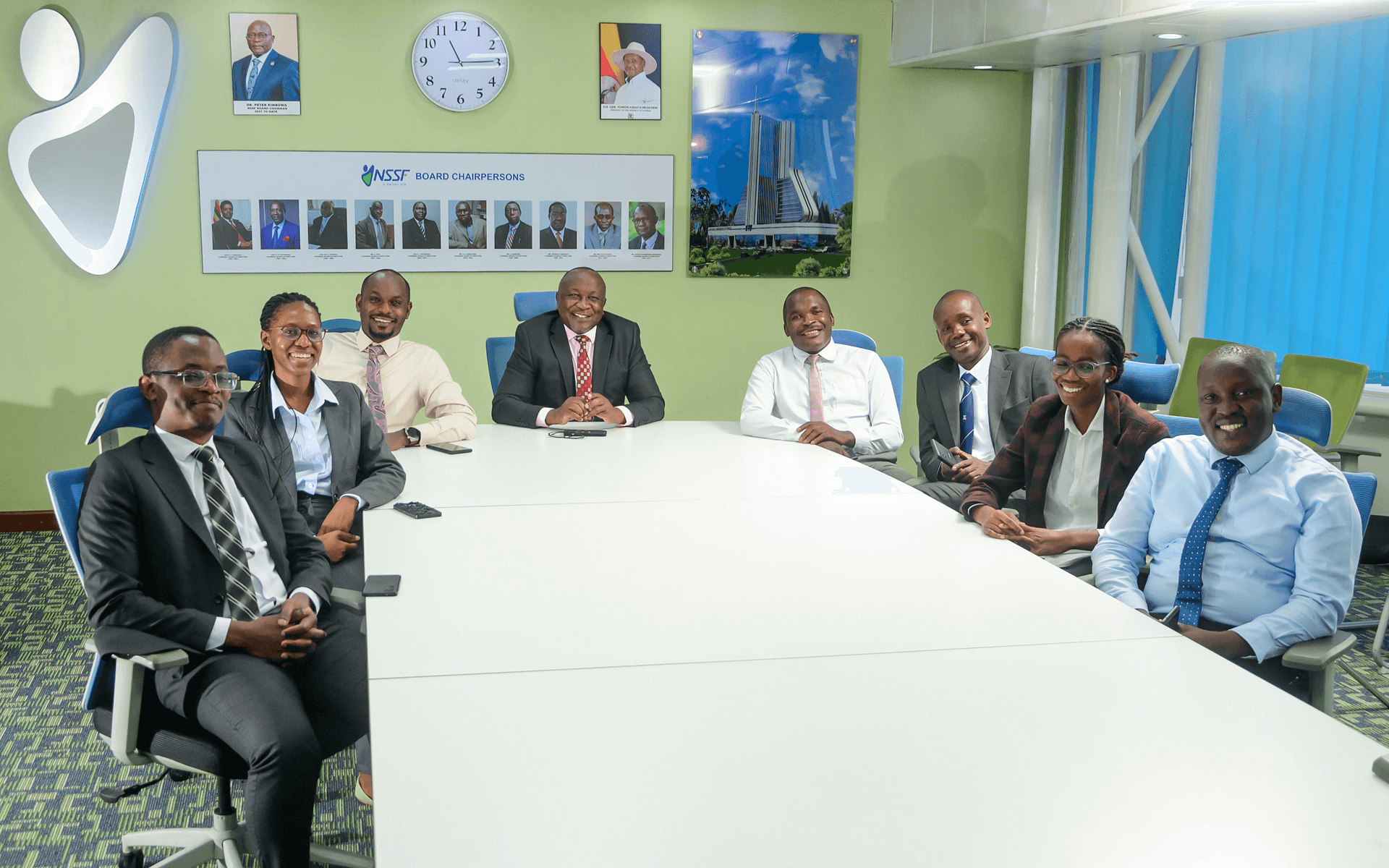

Embedding risk awareness culture

The Enterprise Risk Management Team

We believe effective risk management begins with awareness. Our comprehensive risk awareness programme includes face-to-face training and sensitisation for employees.

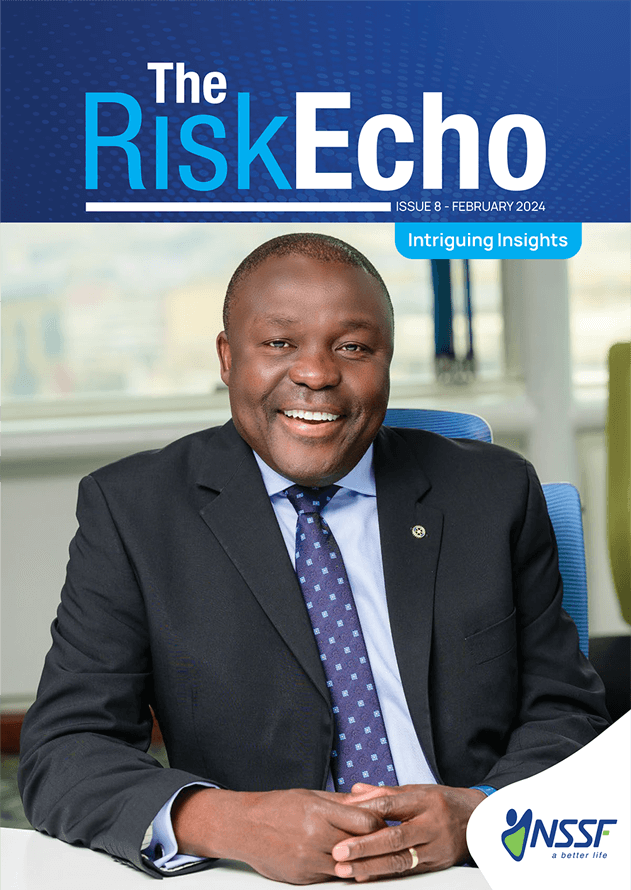

Additionally, we publish "The Risk Echo," a unique magazine dedicated to risk management topics. This publication features contributions from both internal and external experts and is the only one of its kind in the country.

We issue weekly bulletins to all staff with key advisories on managing various risks.

Read more on the NSSF website.

This extensive risk awareness programme and proactive monitoring have led to 94% staff satisfaction with the Fund's risk management culture, as reported in a recent survey.

Knowledge transfer though benchmarking

In FY 2023/24, NSSF was recognised as a benchmark for excellence in enterprise risk management. We hosted employees from NAPSA (Zambia), the Public Procurement and Disposal of Public Assets Authority (Uganda), and the Uganda Electricity Transmission Company (UETC) Ltd, who sought to learn from our practices.

Resilience

The Fund operates a fully-fledged disaster recovery site with real-time data replication from our primary location at Workers House. However, merely having the site is not enough; it must be rigorously tested to ensure effective recovery during major incidents. In June 2024, we conducted a comprehensive disaster recovery test, simulating a worst-case scenario where the primary site was assumed destroyed, and all operations shifted to the recovery site. The test results indicated that we met our target recovery time objectives for all critical systems.

A NEW DAY - CREATING SHARED VALUE FOR SUSTAINABLE GROWTH