OUR BUSINESS:

Risk and Opportunity management

Key risks in 2023/24, treatment, opportunities, trend and outlook

This section provides a comprehensive overview of the risks faced by NSSF, including mitigation strategies, outlook and potential opportunities.

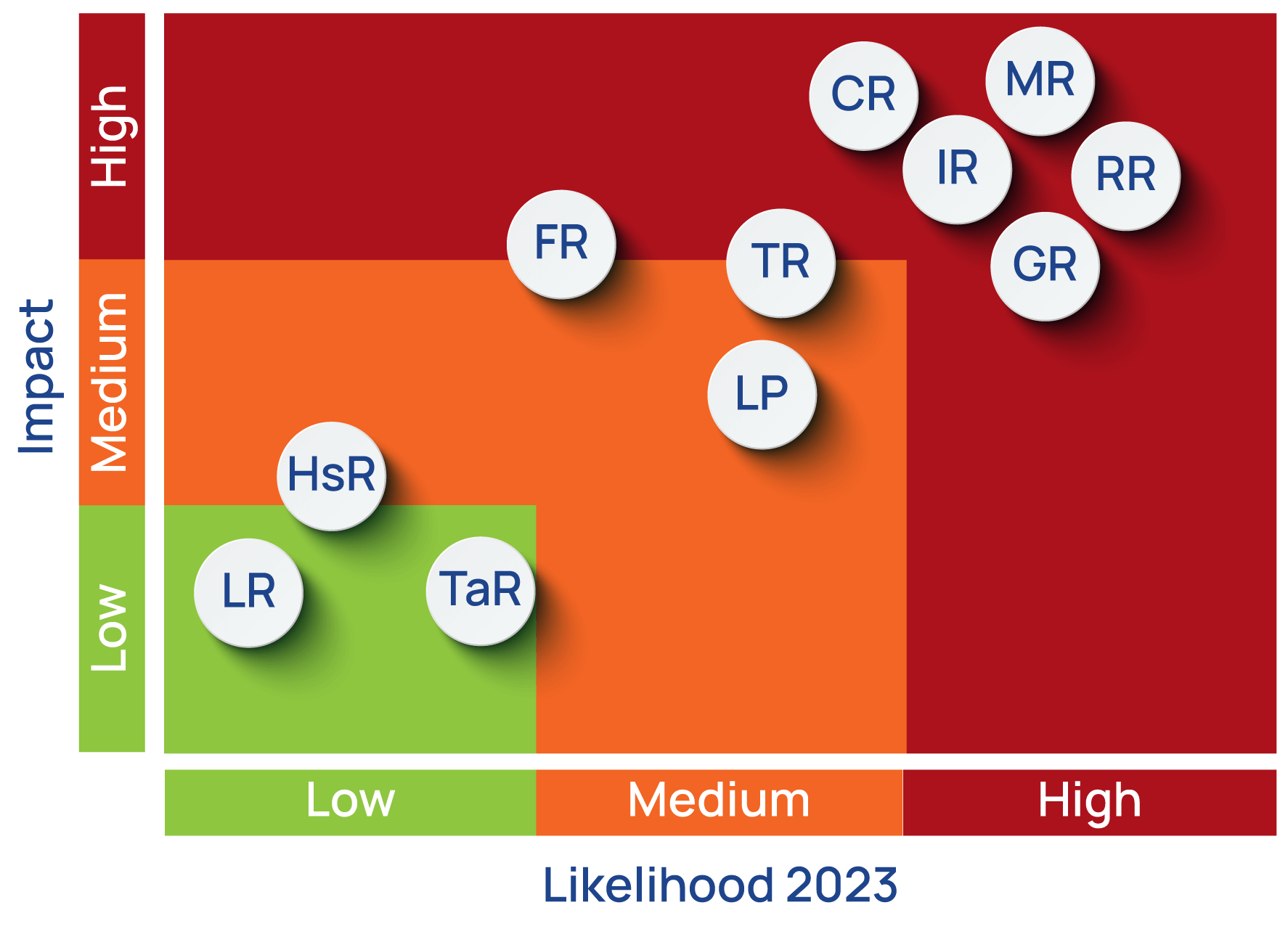

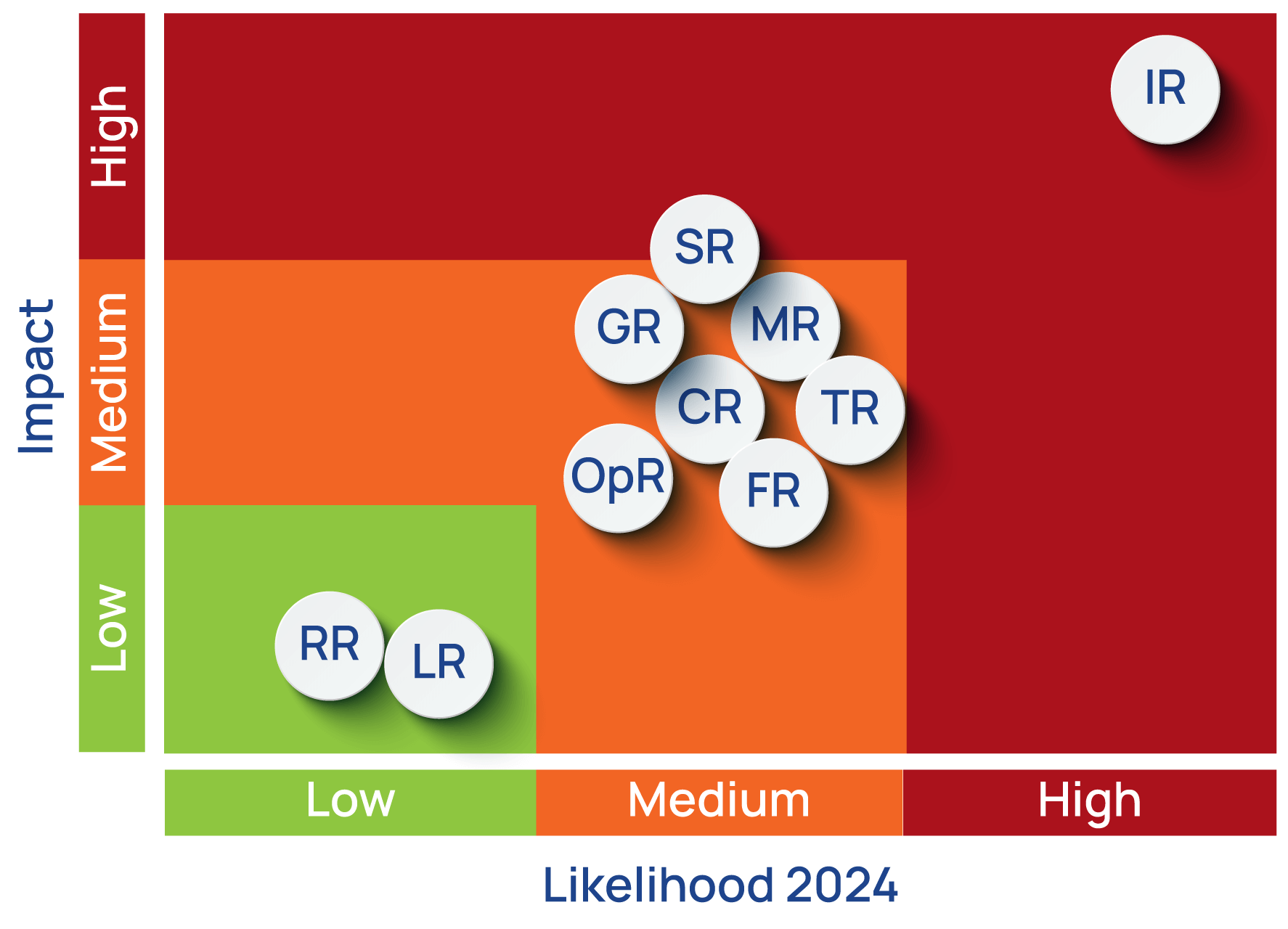

Heatmap (Severity and trend): 2023-24

Legend

Risk severity |

Risk appetite |

Risk movement |

||||||

|---|---|---|---|---|---|---|---|---|

| Low Risk | Medium Risk | High Risk | Within risk appetite | Exceeds RA but within tolerance limit | Exceeds tolerance limit | Risk is likely to increase | Risk is likely to reduce | Risk is not likely to change |

Risk, treatment and the outlook

Risk severity

Risk appetite

Outlook

Risk and mitigation

The Fund relies heavily on technology, which expands our attack surface. To mitigate this risk, we conduct regular system vulnerability and penetration testing to address security gaps proactively.

Risk outlook

Cyber risk is likely to escalate due to increasing cyber threats globally and locally.

Opportunity

Attempted attacks provide us with an opportunity to review and assess the resilience of our systems.

Capitals Impacted

Stakeholders Impacted

Material Matters

Strategic Objectives Impacted

Risk severity

Risk appetite

Outlook

Risk and mitigation

Currently, the Fund is engaged in real estate projects totalling approximately UGX 456Bn. These projects have faced construction delays and increased costs due to global inflation caused by the Russia-Ukraine war. To mitigate this risk, we are reviewing the performance of all contractors with a view to holding them accountable to agreed timelines.

Risk outlook

We expect this risk to stabilise or decrease as we address the causes of the delays.

Opportunity

The country's high housing deficit presents an opportunity for significant returns on real estate investments.

Capitals Impacted

Stakeholders Impacted

Material Matters

Strategic Objectives Impacted

Risk, treatment and the outlook

Risk severity

Risk appetite

Outlook

Risk and mitigation

Compliance risk arises from the complex landscape of laws affecting our operations, increasing the likelihood of non-compliance. To manage this, we monitor legislative developments and maintain a comprehensive compliance framework with a zero-tolerance policy for non-compliance.

Risk outlook

New laws and regulatory changes periodically heightens the risk of non-compliance, potentially leading to legal challenges.

Opportunity

Compliance with laws and regulations helps us avoid penalties and enhances transparency and accountability in our operations.

Capitals Impacted

Stakeholders Impacted

Material Matters

Strategic Objectives Impacted

Risk severity

Risk appetite

Outlook

Risk and mitigation

Appreciation of the UGX against foreign currencies, particularly the KES, which represents a significant portion of the Fund’s foreign currency-denominated assets, results in unrealised foreign exchange losses.

We minimise foreign exchange (FX) risk through allocation of more funds to the domestic market (About 63% of the portfolio).

Risk outlook

The expected rise in foreign currency inflows from oil development is likely to strengthen the UGX against foreign currencies, which may lead to FX losses on regional investments.

Opportunity

The oil and gas sector presents significant investment opportunities that can stabilise the UGX.

Capitals Impacted

Stakeholders Impacted

Material Matters

Strategic Objectives Impacted

A NEW DAY - CREATING SHARED VALUE FOR SUSTAINABLE GROWTH