OUR PERFORMANCE:

CIO's Business Review

Equities

The equity portfolio generated a return of 20.07% during the year ended 30 June 2024. This was primarily driven by forex and capital gains in the regional markets; the recovery of the NSE and addition of MTN and Airtel to the Uganda portfolio, to mention but some. Over the last two years performance of listed securities at the NSE came under significant pressure due to various macro-economic developments, both locally and internationally. Protracted global inflation and the subsequent rise in interest rates following the fiscal stimulus packages after Covid-19 in developed markets, led to significant capital reallocation from frontier markets such as Kenya to global markets.

The economic policies pursued by President William Ruto – such as raising taxes, cutting the fiscal deficit, taming inflation, refinancing a maturing Eurobond in June 2024 and stabilising the exchange rate – have been credited with enthusing the investors who are flocking back to the NSE.

Following the election of H.E William Ruto, tough measures were implemented to improve the fiscal position, initially causing unrest and resistance.

The Finance Bill of 2024 included proposals to eliminate subsidies, double VAT on fuel to 16%, increase tax rates for high-income earners, and reduce recurrent and capital expenditures. These measures led to protests that unsettled investors, while global inflationary pressures compounded the difficulty of implementing the proposed changes.

Consequentially, the NSEASI suffered price depreciations in the month of June 2024 as foreign investors became net sellers on the country’s macro issues and negative sentiments of possible spikes in NPLs in the banking sector, and Safaricom’s challenges in Ethiopia. As an index, the NSEASI gained 2.33% year on year to 30 June 2024. However, this is better understood with context. For example, counters like Safaricom which had rebounded to a high price of KES 19.30 on 27 March 2024 retreated to close the year at KES 17.30 (a loss of 10.36% in KES excl. dividends) while KCB which had recorded its highest price in the year of KES 37.60 on 29 May 2024 closed the year at KES 31.25 (a loss 16.9% excl. dividends).

Equity bank which had touched a one-year high price of KES 49.20 on 26 March 2024 retreated to close the year at KES 42.25 (a loss of 14.13% excl. dividends). Nonetheless, the fact that the return on the currency in UGX (when KES is converted back to UGX) was 9.9%and starting the fiscal year from a low base for equity prices of KCB and Equity Bank (KES 29.30 and KES 38.25, respectively), returned an overall positive situation in Kenya. Even Safaricom which was flat in price terms, was positive when adjusted for currency and dividends.

Moreover, Tanzanian counters (just like the year before) continued to offer attractive returns; CRDB (20.7% when adjusted for dividends), NMB (59.3%), and TWIGA cement (11.8%). There were also strong positive returns from associates like; TDB Bank, Housing Finance Bank, and TPS Serena. The net effect was a fair value gain of UGX 306.7Bn from equity investments. This further validates a diversification strategy across different countries and sectors.

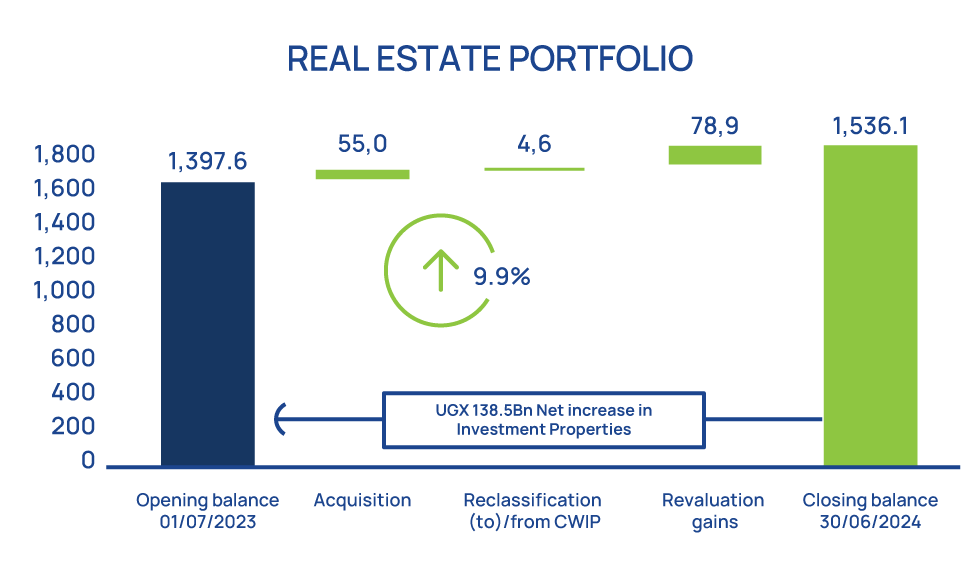

Real estate portfolio

We hold real estate assets to realise capital gains and earn income. Over 40% of this asset class comprises undeveloped land. The strategy is to continuously work towards unlocking the value of some of the prime land through either, commercial developments for rent or the sale of residential units.

The entire real estate portfolio (including non-income generating assets) yielded 5.56% during the financial year to 30 June 2024, which is almost flat compared to last year. This return is mainly attributed to capital gains and sale of residential housing units

Figure 7: The growth in the Fund’s investment properties and work in progress over the last year

Source: Internal

Real estate project information update

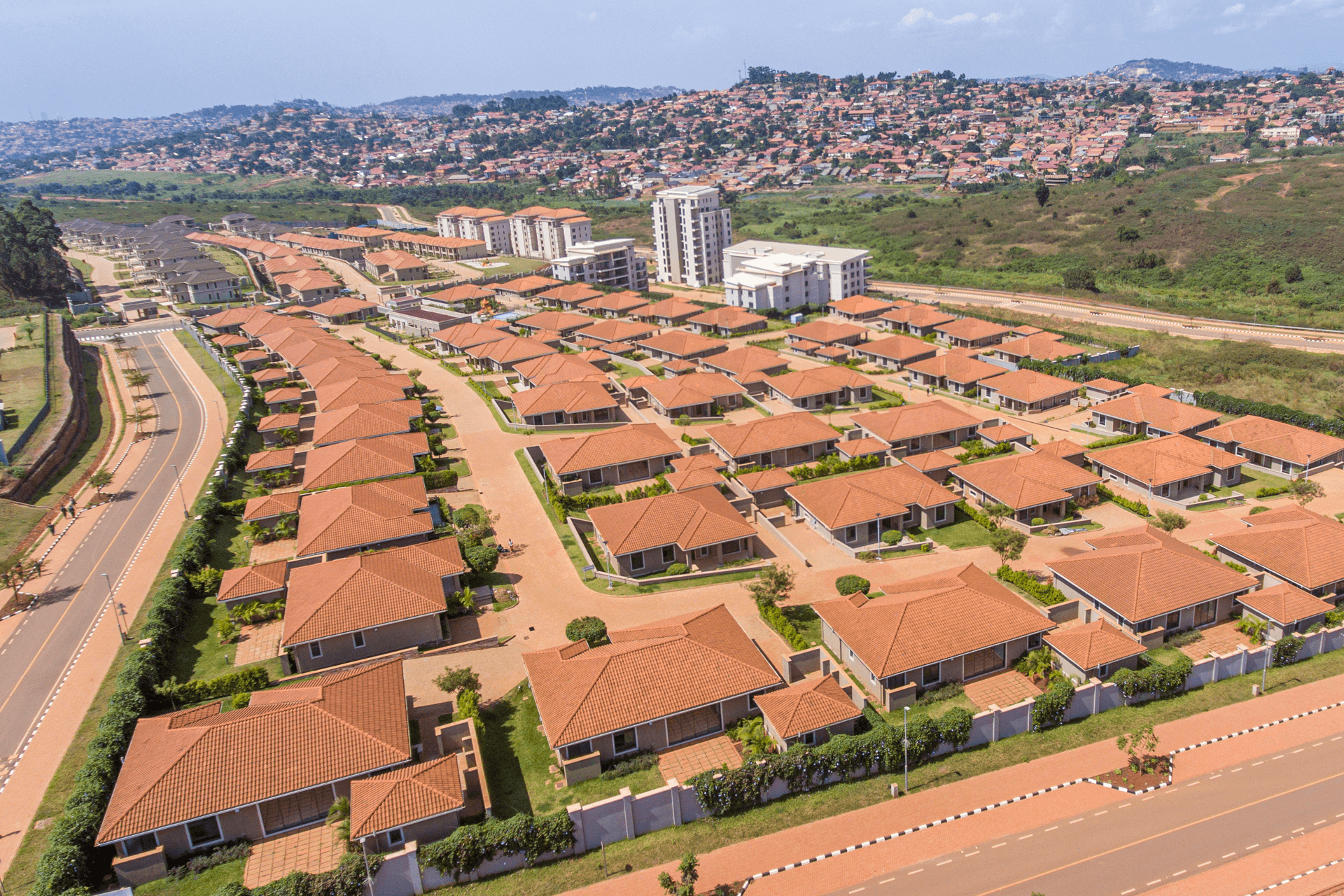

Solana Housing Estate

The Lubowa Housing Project is conceptualised as a self-sustaining satellite city with mixed-use housing and commercial developments on approximately 600 acres. The project branded as Solana is intended as a phased development with construction starting with an initial 306 housing units on 78 acres. Phase 1 will comprise of four (4) distinct house types: Apartments, Bungalows, Townhouses, and Villas.

The progress so far: Selling of housing units is ongoing and the market response has been excellent.

Figure 8: Some of the houses at Solana Lifestyle and Residences

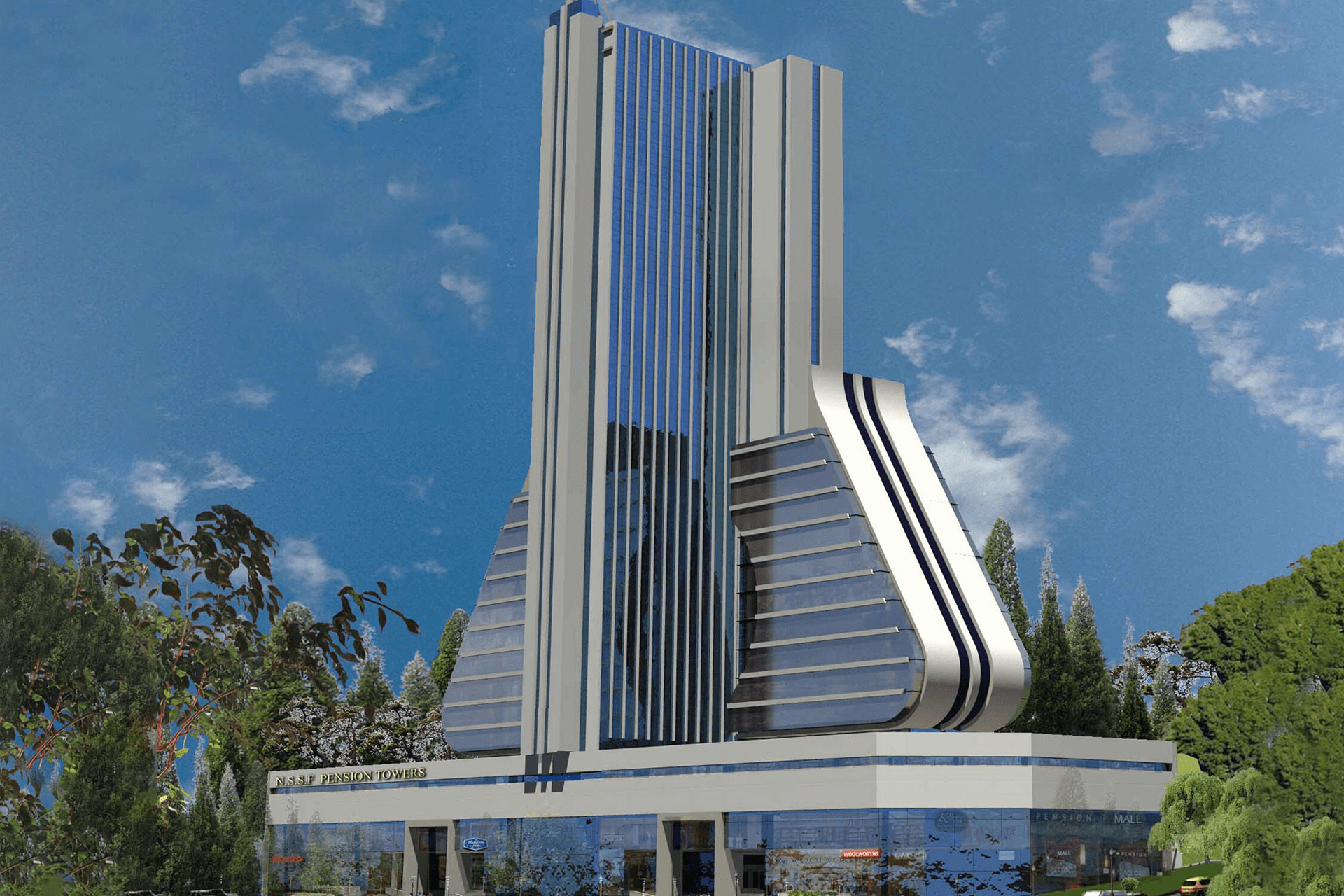

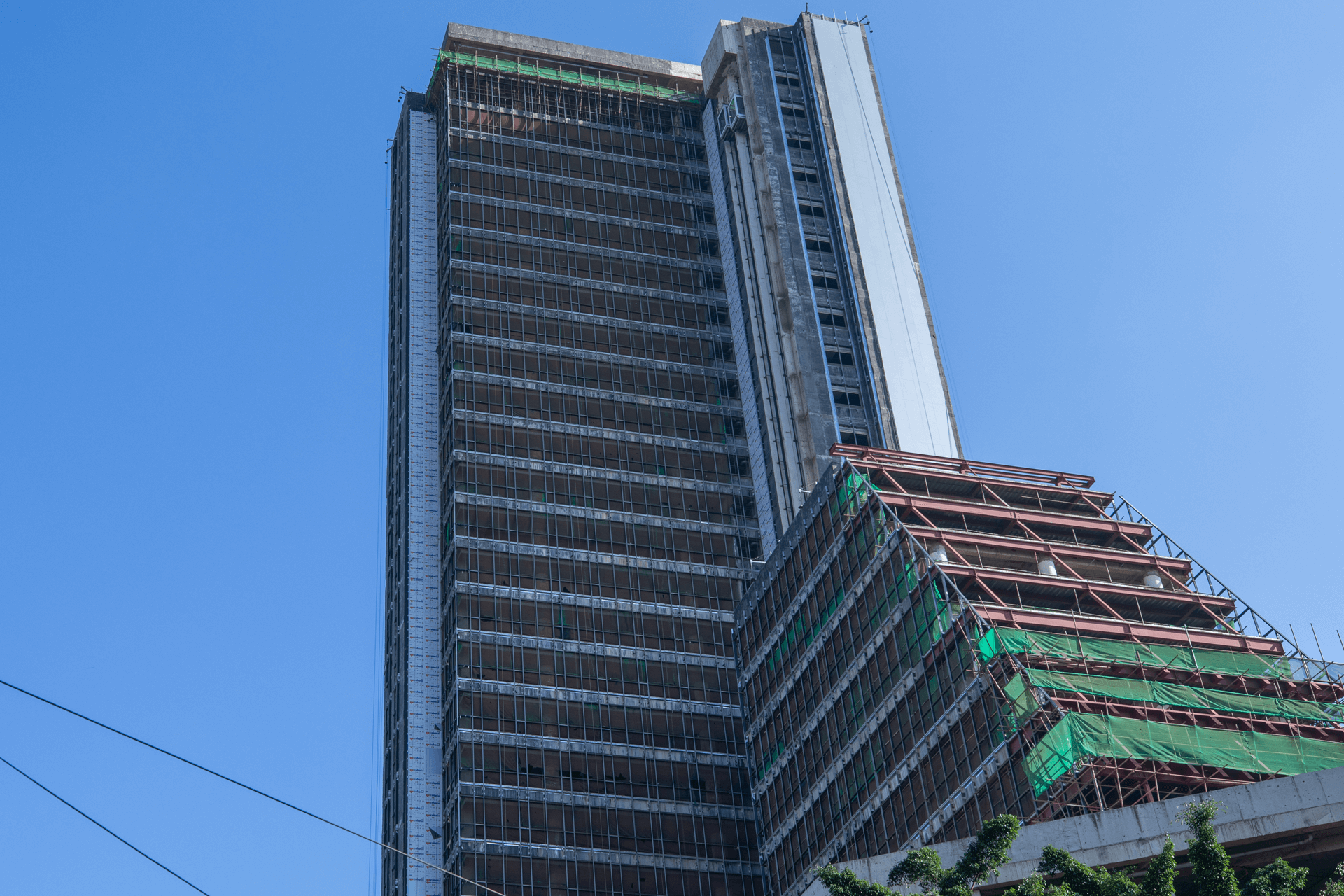

Pension Towers

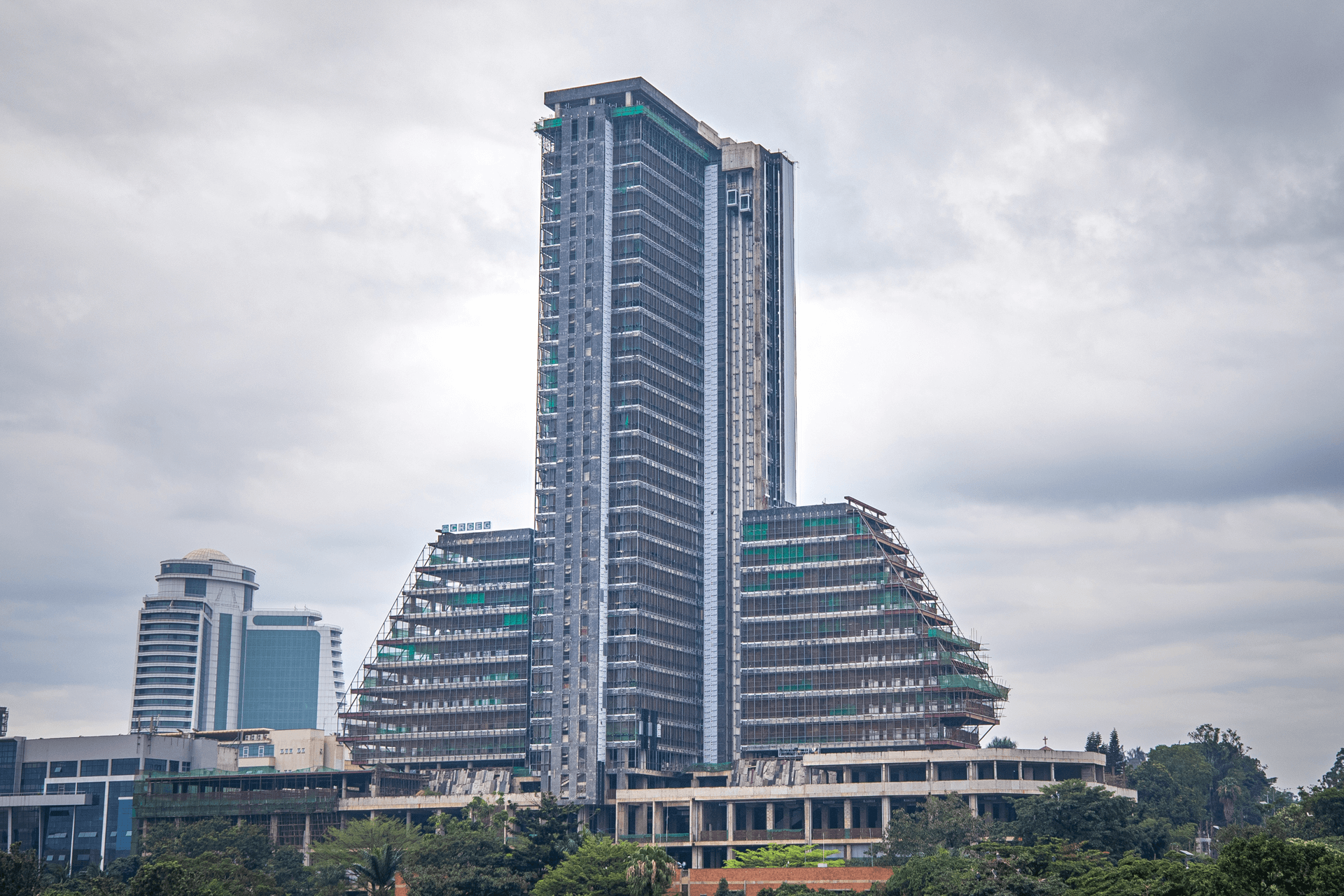

Pension Towers is conceptualised as an intelligent and modern commercial complex comprising 3 Towers (with a height of 32 floors) all sitting on 4 No. basement floors of parking. The total built-up area will be approximately 75,000m2 that will house office and retail space. The project has frontage on both Lumumba Avenue and Nakasero Road.

The progress so far: Construction works are ongoing and as of 30 June 2024, the progress was estimated at 82%.

Figure 9: The progress at pension towers in pictures compared with the artistic impression

Temangalo Housing Project

The Temangalo Housing Project (THP) is a mixed-use affordable housing project under construction on 463.87 acres of land in Temangalo, Wakiso district, just 17 km from Kampala City Centre.

It comprises 3,500 houses, retail and commercial spaces, community amenities including education, health, and social facilities, a large neighbourhood green area/park, and associated infrastructure including roads, electric power, sewage drainage, and water supply.

The progress so far: Construction of Phase 1 started in October 2021 and comprises 550 units; 200 bungalows, 100 townhouses, 50 villas, and 200 apartments, with the starting price being UGX 90M. The construction is scheduled to be completed before the end of 2025.

Figure 10: The progress at Temangalo Housing Project

Outlook for FY2024/25

We intend to continue with portfolio rebalancing. For the fixed income asset class, this will be done by exploring corporate bonds, structured product opportunities, among others. We will also continue to seek more diversification opportunities within Uganda and the East African region.

In the equity asset class, we will explore opportunities in all the markets where we invest including private equity.

In the real estate asset class, the strategy is to continuously work towards unlocking the value of some of the prime land that the Fund owns through either undertaking commercial and mixed-use developments for renting out or building residential houses for sale. About 70 percent of the real estate class comprises undeveloped land. Developing the land is one of the ways of unlocking the accumulated value over time.

A NEW DAY - CREATING SHARED VALUE FOR SUSTAINABLE GROWTH