OUR PERFORMANCE:

CFO's Financial Review

FY2023/24 key performance highlights

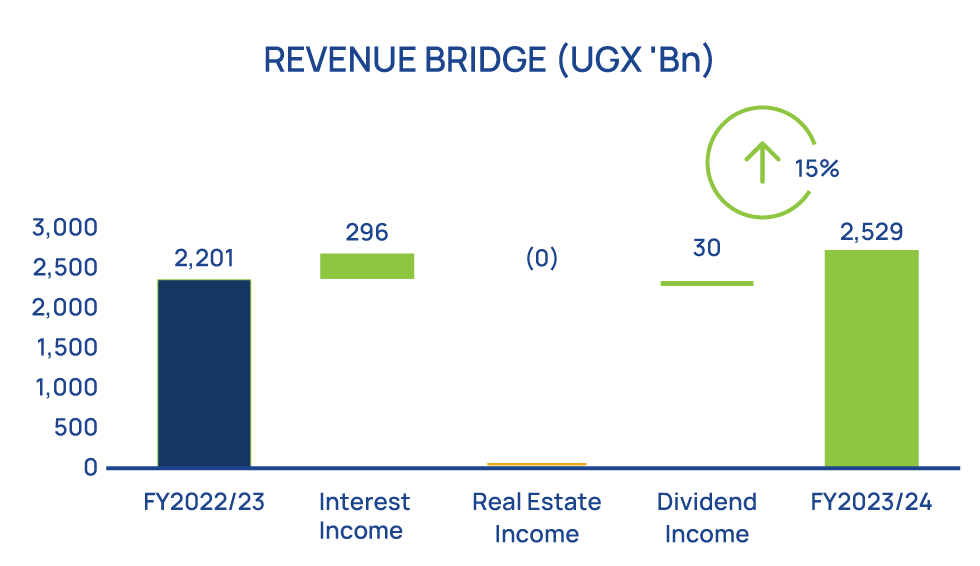

Revenue

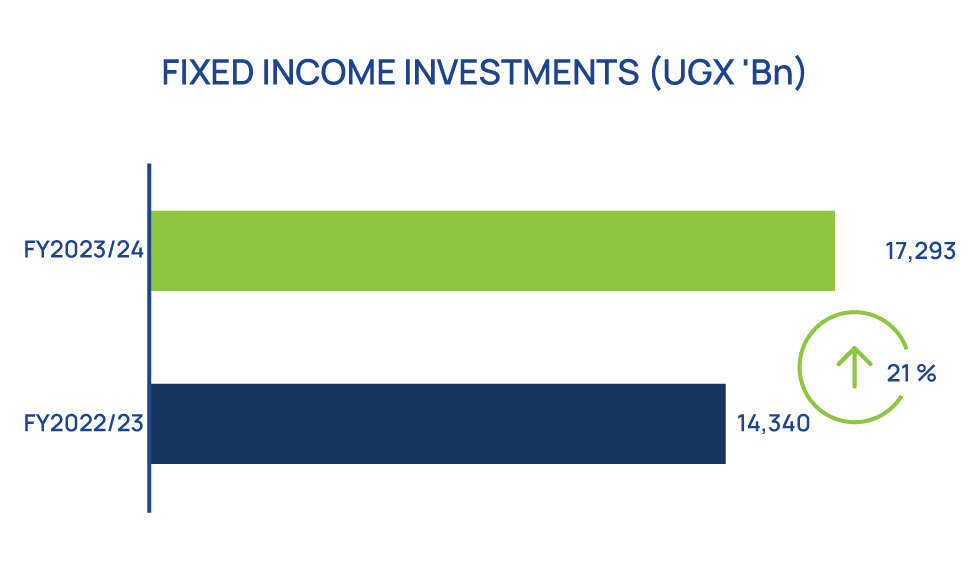

As a result, total realised revenue grew by 15% from UGX 2.201Bn to UGX 2.529Bn driven by the growth in fixed income, dividend income and real estate income.

Operating costs

Annual operating costs increased by 16% from UGX 191Bn in FY2022/23 to UGX 222Bn in FY2023/24, and 3% below the budget of UGX 228Bn. The increase from the previous period is attributed to the Fund’s continuous strides towards its strategic direction (Vision 2035), driven by initiatives to improve sustainable return and benefits to members through the Fund’s expanded mandate, increased strategic partnerships and engagement, processes to boost internal capacity and innovative solutions to improve efficiencies in the delivery of services to our members.

The annual cost-to-income (Total Income) ratio dropped to 7% in FY2023/24, down from 16.45% in FY2022/23, driven by a significant increase in total income due to unrealised exchange gains of UGX 64OBn. The expense ratio also improved, reducing to 1.00% in FY2023/24 from 1.03% in FY2022/23, better than the target of 1.08%.

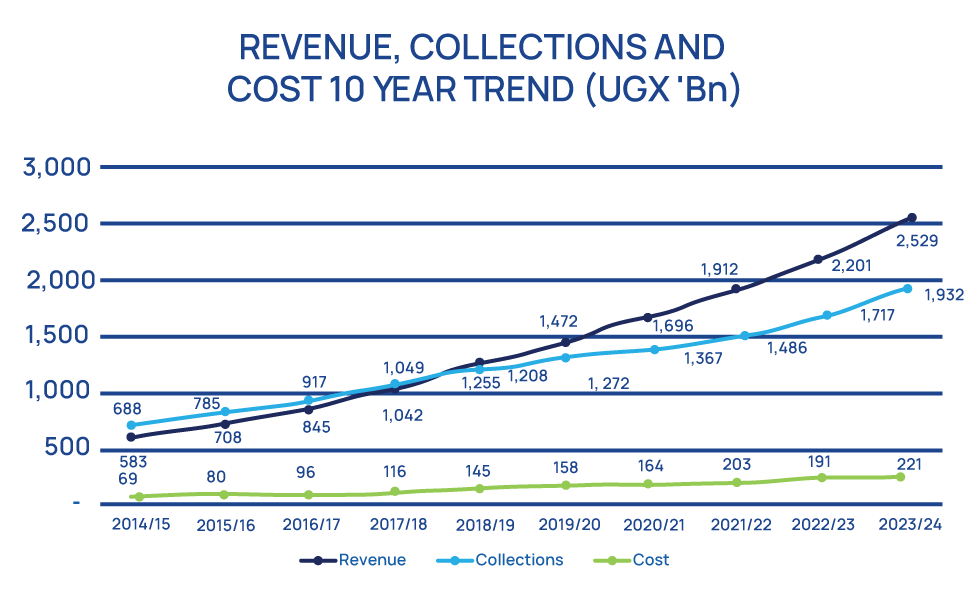

Whereas revenue and collections have grown by a compound annual growth rate (CAGR) of 18% and 12% respectively, costs have only grown by a CAGR 13% over a 10-year period (FY2013/14-FY2023/24). Revenue has posted significant growth over the historical period, and it continually surpassed collections from FY2018/19 onwards. Revenue was higher than collections by 4% in FY2018/19 versus 31% in FY2023/24 and this gap continues to grow.

Interest credited to Members

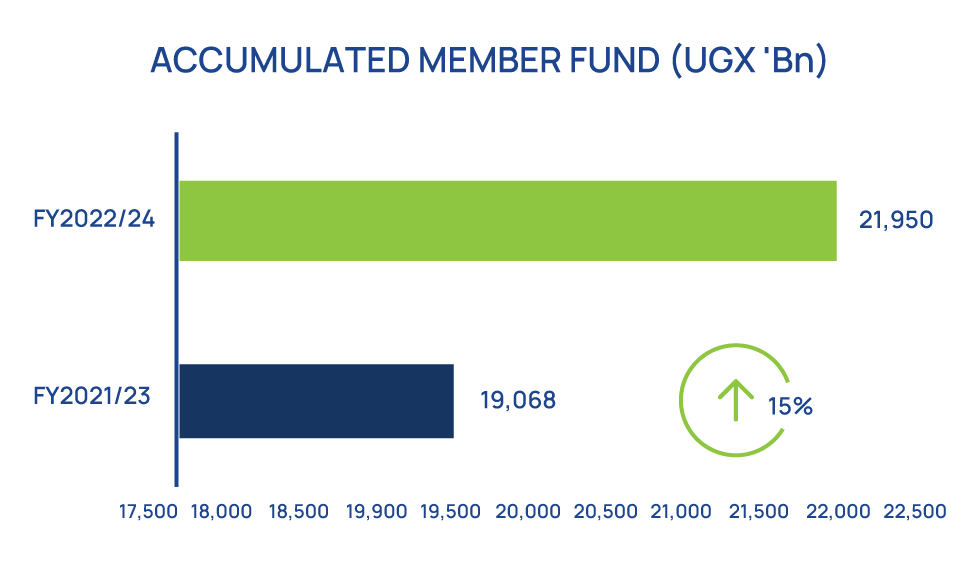

The Fund declared a return to members of 11.5% in FY 2023/24 resulting in UGX 1.963Bn compared to 10% in FY 2022/23 which resulted in UGX 1.584Bn.

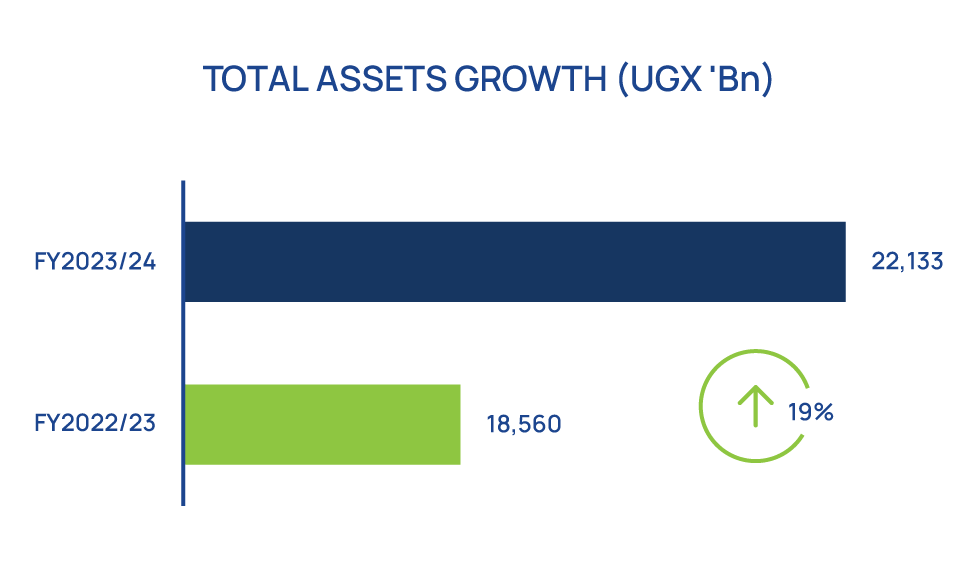

Financial position

A NEW DAY - CREATING SHARED VALUE FOR SUSTAINABLE GROWTH